USTR Issues 4-year review of the Section 301 Tariffs; Adds New Tariffs, including on Electric Vehicles, Lithium Batteries, Semiconductors

On May 14, 2024, the U.S. Trade Representative (“USTR”) published the Four-Year Review of Actions Taken in the Section 301 Investigation (“Report”), which addresses the four-year review of China-related tariffs under Section 301 of the Trade Act of 1974, as amended (“Trade Act”) (19 U.S.C. 2411). Our previous alert on the 2018 Section 301 Investigation findings is available here.

SOURCE: Pillsbury Global Trade and Sanctions Blog

Per the Trade Act, the USTR is required to conduct a review every four years to consider (1) the effectiveness of the Section 301 tariff actions in achieving the objective of the investigation; (2) other actions that could be taken; and (3) the overall effects of the tariff actions on the U.S. economy. The resulting report makes the following conclusions:

- The Report recommends that products already subject to Section 301 tariffs should continue to bear those duties.

- It proposes new or increased tariffs on products in certain strategic sectors, including electric vehicles, lithium batteries, semiconductors, critical minerals, and steel and aluminum. The effective dates for the tariff changes have not yet been made public.

- Finally, the Report describes an exclusion process for certain domestic manufacturing machinery in Chapter 84 & 85 of the HTSUS and 19 temporary exclusions for specific solar manufacturing equipment.

- A Federal Register notice is expected to be published next week with further details and a request for comments.

Below, we describe the actions and USTR’s findings.

Background

In August 2017, the USTR initiated an investigation under Section 301 of the Trade Act to determine whether actions of the Government of China relating to technology transfer, intellectual property, and innovation were unreasonable or discriminatory and burden or restrict U.S. commerce. Following a positive finding, USTR imposed duties upon a wide range of Chinese-origin products. The duties were implemented through four separate “tranches” in 2018 and 2019.

The governing statute requires that Section 301 duties be reviewed every four years.

In May 2022, the USTR began its review of the tariffs by notifying domestic industry representatives of a potential termination and allowing them to request continuation. In September 2022, the USTR confirmed the continuation of the tariffs and initiated a review of their effectiveness. Over the next eighteen months, the USTR received more than 1,500 public comments and conducted numerous meetings with other agencies.

USTR Finds that Section 301 Tariffs Should Remain

The Report states that the Section 301 tariff actions have prompted China to begin addressing and reducing the negative effects of some of its technology transfer-related policies, and practices. It also states that the Section 301 tariffs have decreased U.S. exposure to those problems by encouraging companies to shift sourcing and production away from China. According to the Report, although China has made some progress, it has not fully eliminated many problematic technology transfer-related practices that continue to burden U.S. commerce. Instead, according to the Report, China has intensified its efforts, particularly through cybertheft and cyber intrusions, to acquire U.S. technology and intellectual property without consent.

The Report concludes that in order to encourage China to address these issues, USTR recommends that the current Section 301 tariffs should continue.

Proposed Modifications to the Section 301 Actions for Strategic Sectors

USTR has proposed adding or increasing Section 301 tariffs for certain products in strategic sectors, which allegedly are targeted by China for dominance or have seen recent investments by the United States.

The Report discusses the need to target industries to which it refers as China’s high-tech “new three,” which includes solar products, lithium-ion batteries, and electric vehicles. The report states China has focused on becoming the global leader in processing critical minerals, such as graphite, essential for the supply chains of electric vehicle batteries, solar products, semiconductors, and other key technologies. Reportedly, the tariff increases on critical minerals are expected to also include cobalt, manganese, zinc, tantalum, and tungsten. The proposed tariff adjustments are intended to align with significant U.S. investments in clean energy, semiconductor production, and infrastructure under initiatives like the Inflation Reduction Act and the Bipartisan Infrastructure Law. Higher tariffs for semiconductors also are aimed to counter China’s rapid in that sector, while tariffs on steel and aluminum are intended to address global market distortions said to be caused by Chinese overproduction. Furthermore, proposed tariff increases on ship-to-shore cranes aim to safeguard U.S. security interests against Chinese cyber intrusions, while higher tariffs on critical medical supplies have the goal of ensuring adequate domestic production capacity for public health emergencies.

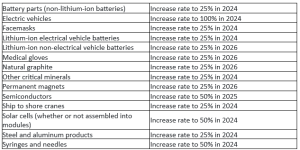

The Report provided the following general list of proposed increased tariffs:

Notably, a number of the proposed tariff increases will not come into effect until 2025 or 2026, in an effort to allow time for the diversification of supply chains in the affected industries. At this time, specific Harmonized Tariff Schedule numbers that would be subject to the increases are not identified.

Additional Recommendations

The Report includes four additional recommendations:.

- Proposed exclusion for machinery used in domestic manufacturing

USTR recommended establishing an exclusion process specifically targeting machinery used in domestic manufacturing. This process will be restricted to machinery falling under specific eight-digit tariff lines in Chapters 84 and 85 of the Harmonized Tariff Schedule of the United States (HTSUS). USTR also proposed nineteen 19 temporary exclusions for certain solar manufacturing equipment to support investment in U.S. solar manufacturing. The Report does not mention any extension of other existing exclusions.

- Additional funding for CBP towards enhanced enforcement

USTR proposed measures to maintain the effectiveness of Section 301 actions by ensuring proper assessment of Chinese goods subject to Section 301 duties. The Report states that allocating additional funds to CBP would enhance enforcement efforts, improving the effectiveness of Section 301 actions and similar trade measures.

- Promoting Private Sector Awareness, Cooperation, and Action

In order to protect U.S. companies against cyber intrusions and economic espionage, USTR recommends greater collaboration between private companies and government authorities, intensifying efforts to identify and address cyber vulnerabilities, and promoting timely reporting of suspected intrusions to law enforcement for prosecution. U.S. companies are urged to prioritize cyber defenses, invest in infrastructure and services, and disclose information on cyber defense efforts to increase investor support.

- Continue to Assess Approaches to Enhancing Supply Chain Impacts

USTR recommended a focus on building resilient, diverse, and secure supply chains to bolster economic prosperity and national security, in line with Executive Order 14017. The report recommends that USTR, government agencies, and the U.S. Congress assess approaches which will shift supply chains away from China and enhance the supply chain impact of the Section 301 tariffs.

Impact

The long-awaited four-year review of Section 301 actions by the USTR signals a drastic increase on tariffs in certain sectors, without easing existing measures. A Federal Register notice is expected to be issued next week that will announce new procedures for comments on the proposed modifications, additional detail on affected tariff classifications, and information concerning the exclusion process for machinery used in domestic manufacturing.

The US-China Economic and Security Review Commission will be conducting a hearing May 23, 2024, entitled “Key Economic Strategies for Leveling the U.S.-China Playing Field: Trade, Investment, and Technology.” The hearing will address some of the issues raised in the Administration’s report. Further details of this hearing are available here.