Understanding Component Shortages (and How to Survive Them)

Originally posted on Jabil Blog

Graham Scott, Vice President Global Procurement, Jabil

Managing 700,000+ parts across more than 27,000 suppliers at any given time provides us with unique insight into key commodity trends, strategies and component shortages. Therefore, as you might imagine, it’s been an interesting few years for global procurement.

Since late 2017, companies managing electronic components have been facing challenging times with successive waves of supply shortages, price hikes and lengthening lead times. A major surge in demand on one side and a critical materials and parts shortage on the other strained capabilities to meet demand, especially for more standard passive components, such as multilayer ceramic capacitors (MLCC), resistors, transistors, diodes and even memory. Suppliers were quoting lead times averaging 20-30 weeks—and this is all before the pandemic.

Throughout 2019, market dynamics actually improved steadily as the investment plans made by suppliers increased their capacity and correlative output. We also saw original equipment manufacturers (OEMs) execute new multi-source strategies in order to reduce supply risk.

In a 2019 Supply Chain Trends Survey, 48% of the surveyed supply chain decision-makers at OEMs said they were revising their approved vendor lists. Furthermore, 45% were evaluating multivendor sourcing strategies.

There were no major supply shortages in 2019, and by the middle of the year, the passive components market was relatively balanced. In fact, 74% of survey participants said they thought the market would be even better in 2020. This was true for the first few months of the year.

COVID-19 Stifles Production and Shifts Suppliers’ Operational Focus

Then the COVID-19 pandemic hit, and market capacity shrunk significantly. The pandemic’s epicenter—Wuhan, China—is home to many electronic and mechanical suppliers. When the area went on lockdown and factories could not produce at full capacity or at all, there was not enough supply to meet demand, but the greater impact was felt as the virus spread throughout China.

As the coronavirus spread around the world, so did the components shortages. Factories in Malaysia, the Philippines and Indonesia couldn’t produce or ship parts. As a result, OEMs worldwide could not manufacture their own products either.

Ultimately, it did not matter where the supplier was or where the end product was produced; entire supply chains were clogged by the pandemic, and all the inventory and flexibility had been sucked out of the market. The lead time for high-end semiconductors, which is usually long, doubled from 18 weeks to 36 weeks.

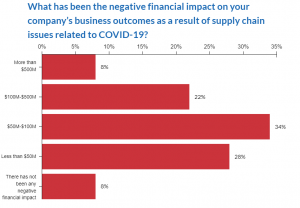

On top of that, supply chain issues related to COVID-19 have cost companies millions of dollars. According to Jabil’s Special Report: Supply Chain Resilience in a Post-Pandemic World, about two-thirds of surveyed OEMs lost $50 million or more because of these issues. About one-third lost more than $100 million, and 8% lost more than $500 million.

When components suppliers were able to manufacture, many shifted their operations to prioritize parts for the healthcare industry. At the start of the pandemic, there was a worldwide shortage of ventilators as well as rising needs for X-ray machines, diagnostic tools and other medical devices that use electronic components. Appropriately, suppliers contributed their capacity to lifesaving efforts.

However, as those needs are being fulfilled, component manufacturers are starting to shift back to pre-COVID-19 operations. Back then, these companies were making calculated investments to support leading-edge technologies that primarily support the automotive, smartphone and 5G/Internet of Things (IoT) markets.

How the Automotive Industry Influences the Electronic Components Market

The automotive industry has been experiencing a rapid transformation, with products incorporating automotive electronic components at an unprecedented rate. Although we may be a few more years away from fully autonomous vehicles, cars are evolving to become even more sophisticated with embedded software, sensors, artificial intelligence, connectivity and yes, electrification.

Think of today’s standard combustion engine car, which has somewhere between 2,000 and 3,000 capacitors. As the electric vehicle gains market share, this creates an overwhelming growth in content with as many as 22,000 MLCCs required in a single car. This number will continue to grow as more functions become electrified.

Automotive electronic components sell at higher price points because of the additional requirements related to warranties and liability. Demand from the automotive sector also is somewhat stable with accurate forecasts. This makes the automotive market a high priority for component suppliers.

McKinsey and Co. predicts that the global automotive market will grow by at least 1-5% in 2021, partially because demand for new vehicles dropped in 2020. However, if governments offer incentives to car buyers, the segment could grow by 28-36% from the 2020 level. This would create even more demand and opportunities for the electronic components industry.

Smartphone Miniaturization Leads to Component Shortages

Like the automotive industry, the smartphone industry is constantly on the move. As consumers expect the release of a greater model each year, leading smartphone launches have become anticipated events. For passive components and memory products, smartphones represent a significant part of overall consumption.

The math is simple but insightful. There are approximately 1.5 billion smartphones manufactured per year, and each flagship model contains roughly 1,000 capacitors. This means that smartphone manufacturers use about half of the roughly 3 trillion MLCCs produced globally each year. This makes the smartphone market the primary driver of consumption and technology.

However, demand from this segment has been decreasing in recent years. The smartphone market was already slowing down prior to 2020, and the COVID-19 pandemic drove the global smartphone market into its worst decline ever, according to Gartner. Global shelter-in-place guidelines combined with economic uncertainty resulted in a 20.2% decrease in smartphone sales. Similarly, smartphone manufacturers had to stop or slow down operations because of temporary closures early in the pandemic.

As the market reaches a new normal, smartphone demand could increase again, and the supply-demand picture could flip. Smartphone companies that primarily rely on physical retailers or carriers to sell their phones will have a tougher time regaining sales, but as more smartphone providers shift to online sales and make their products more accessible, sales will likely rise again.