U.S. Department of Commerce’s Cancellation of Preferential Treatment for Hong Kong to Impact Semiconductor Industry’s Geographical Concentration and Manufacturing Strategies, Says TrendForce

The U.S. Department of Commerce announced on June 29 that the newly instituted Hong Kong national security law by the Chinese government will increase “the risk that sensitive U.S. technology will be diverted to [the Chinese government]”; the Department therefore put a temporary stop to the preferential treatment the U.S. had afforded to Hong Kong. TrendForce indicates that, as Hong Kong is a major site of chip warehousing for manufacturers and distributors worldwide, the U.S. government’s withdrawal of preferential treatment is meant to directly curtail the risk that companies may export products that contain sensitive information, through Hong Kong, to China. This action is thus expected to drastically change the current geographical concentration of semiconductor products and the production strategy of chip manufacturers.

On April 27, 2020, the U.S. Department of Commerce expanded its export control actions in an effort to prevent China, Russia, and Venezuela from acquiring U.S. products and technologies “that could be used in development of weapons, military aircraft, or surveillance technology through civilian supply chains”. Of the actions that were announced, the Expansion of Military End Use/User Controls (MEU) and the Removal of License Exception Civil End Users (CIV) have been put into effect, with the Elimination of License Exception Additional Permissive Reexports (APR) Provisions (which, according to the Department of Commerce, “proposes to eliminate certain provisions of a license exception for partner countries involving the reexport of NS- (national security) controlled items to countries of national security concern to ensure consistent reviews of exports and reexports of U.S. items”) still under review even though the U.S. was originally to confirm the details, including implementation date, by June 29, 2020.

Although the Elimination of License Exception APR Provisions has yet to be finalized by the Department of Commerce at the time of this press release’s publication, TrendForce believes that the U.S. government’s temporary suspension of preferential treatment, including export license exceptions, for Hong Kong, is essentially equivalent to finalizing the Elimination, at least in terms of intended consequences.

According to TrendForce’s analysis, because Hong Kong had been afforded preferential treatment in the past, the region saw the emergence of a substantial semiconductor spot market and became a warehousing hotbed for many chip manufacturers. However, with the cancellation of preferential treatment, changes in the geographical concentration of semiconductor products and chip manufacturing strategies are likely to take place as a result. As such, related actors in the semiconductor supply chain already began investigating possible scenarios and making corresponding strategic adjustments in response to the tightening of the Export Administration Regulations in April.

However, with the drastic shifts in international relations, not only must companies now take into consideration the time required to apply for a special export license should they wish to export tech products, such as semiconductor components, to China through Hong Kong, but these companies must also take other factors into account. These factors include the products’ manufacturing processes and shipping routes, as well as the parties to whom the products will be delivered. Companies wishing to ship tech products must take great care in planning every detail, in order to avoid violating the export regulations.

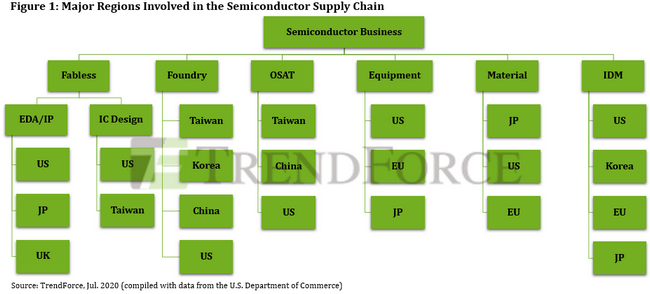

TrendForce stresses that Taiwanese semiconductor companies occupy an important position in the global foundry, OSAT, and IC design industries. Therefore, in the face of the U.S. government’s increasingly stringent export regulations towards China, TrendForce believes that Taiwanese companies need to be more careful than ever, so as to avoid being impacted by the export controls under the U.S.-China trade war.