The Worldwide Electronics Manufacturing Services Market – 2022 Edition

New Venture Research (NVR) announces the publication of its annual electronics manufacturing services report, The Worldwide Electronics Manufacturing Services Market – 2022 Edition.

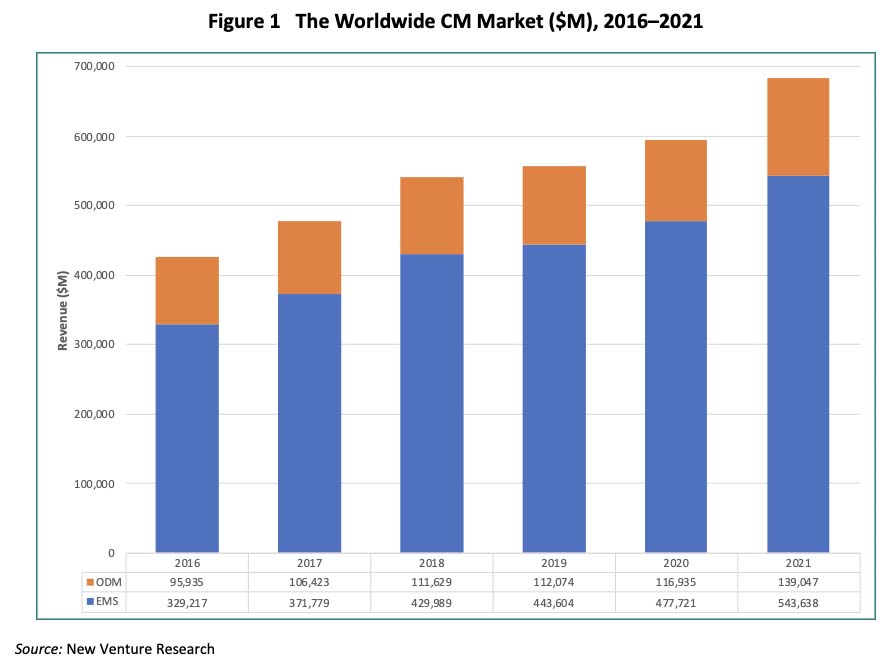

Total industry CM growth for contract manufacturing (EMS and ODM) increased significantly in 2021, achieving a new record of $683 billion, which represented 14.8 percent growth from the previous year. Growth for the ODM industry was quite a bit higher than for the EMS industries, achieving an 18.9 percent increase while the EMS market only increased by 13.8 percent. The highest-growth applications were found in the computer industry, with a surge in demand for the latest versions of notebooks, servers, and replacement of older computer ancestry. These equipment purchases were spawned in the covid pandemic as workers have had to stay indoors and isolated except for video and Zoom calls for most of 2021. Figure 1 shows total revenue by supplier type for 2016–2021.

The CM market was sustained by the strong demand for notebooks, smartphones, servers, and enterprise storage systems that are supporting the spread of cloud computing and social networking while workers endured stay-at-home isolation by their governments and employers. Capital spending in wireless infrastructure and enterprise LANs was strong and driven by the building out of the 5G wireless networks (soon 6G) in many regions in 2021 by OEMs such as Cisco, Ericsson, Huawei, Nokia, and Samsung, and supported by wireless carriers like AT&T, China Mobile, Deutsche Telekom, Mobile T, NTT DoCoMo, Reliance Jio, SK Telecom, Verizon, and Vodafone.

The pandemic-caused downturn in CM revenue was not as severe in 2021 as it was in 2020, resulting in some recovery in certain industries such as transportation and retail. The information technology industries—computing and communications—drove growth in revenue as replacement sales took over. Indeed, all industries grew for EMS and ODM companies in 2021, although the medical sector did not profit as much as first assumed because suppliers shifted their attention from high-cost product assemblies to more low-cost emergency hardware. Therefore, the limited recession that happened was quickly forgotten as people strived to return to normal. Details of the market growth are profiled in the full report.

For the twelfth year in a row, the industry was profitable, at $16.2 billion, the highest ever recorded (for 36 EMS public companies and 14 ODM public companies), increasing by $4.4 billion from 2020. Foxconn accounted for almost one-third of all the profit ($5.0 billion) made by the EMS industry in 2021, and EMS companies accounted for approximately 66 percent of the CM total revenue. (Five EMS companies and no ODM companies lost money in 2021.) Second in line was Quanta Computer who earned $1.3 billion, followed by Luxshare Precision who ranked third in total earnings ($1.1 billion). Delta Electronics earned $959 million, Pegatron earned $896 million, and Jabil produced $696 million.

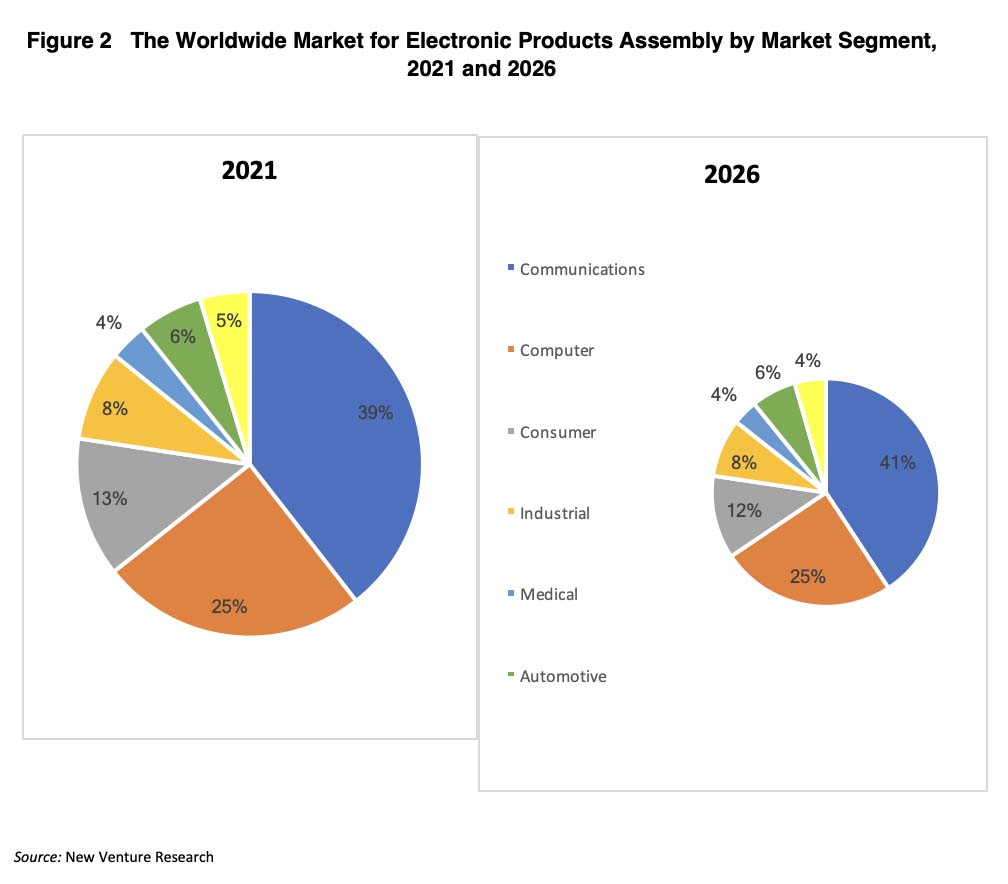

Figure 2 summarizes the worldwide assembly market for all electronics products for 2021 and 2026 by market segment. The largest market in size is the communications segment, with its dominance by smartphones, which have almost replaced PCs. The traditional computer market is not far behind, with steady need being driven by business machines, servers, and specialty tablets. The consumer market ranks third, being sustained by strong demand for digital TVs. The industrial market ranks fourth in size, followed by the automotive and aviation/defense/other transportation segments, and lastly by the medical equipment market. All these market segment for electronics product assembly totaled approximately $1.4 trillion in total assembly revenue in 2021.

The overall market demand for electronics products should continue growing throughout the forecast period at a CAGR of 6.8 percent over the next five years. Communications and medical products will continue to be the segments driving the largest growth in the electronics industry. In 2026, the total industry is expected to reach $1.8 trillion in annual assembly value (COGS), as consumption and replacement of electronic products continue and new products sustain demand. Subsequently, outsourcing has proven itself as a critical element in keeping the electronics assembly industry expanding and innovating each year, which is a leading factor in stimulating continuous consumer demand. Moreover, the trend to move price-sensitive manufacturing to low-cost regions will impact the industry for all suppliers in the foreseeable future.

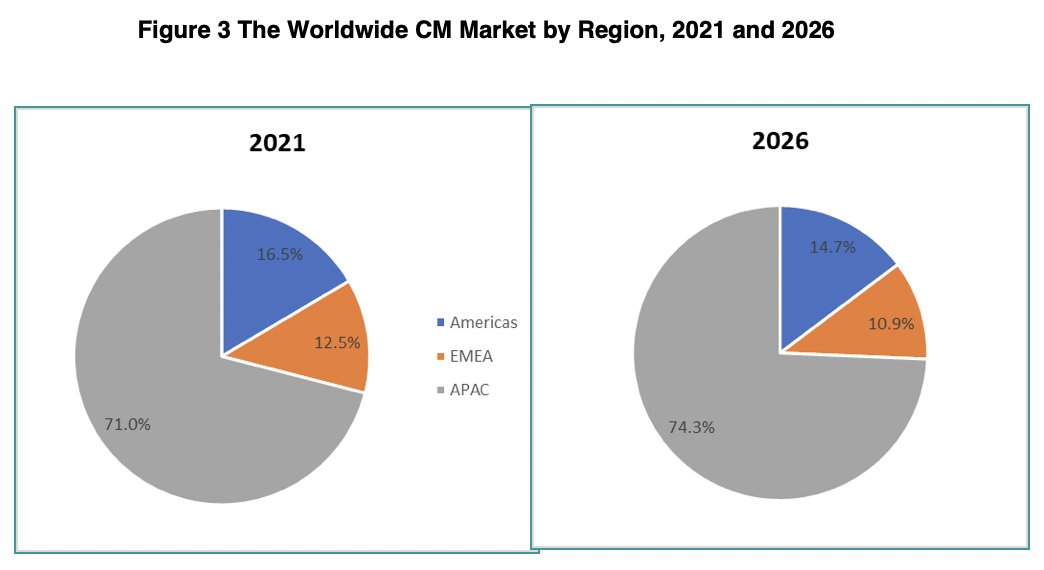

Figure 3 compares the worldwide CM market by region for 2021 and 2026. The shift in production to low-cost regions has been largely accomplished, although some migration will continue unless tariff impositions reverse the market growth, which seems likely. However, increasingly we are seeing OEM customers insisting that their CM partners manufacture products near the regions where the products are to be sold, which includes more business for Mexico and Eastern Europe. For certain high-volume products like smartphones and PCs, OEMs need to leverage the lowest cost in manufacturing, and labor cost differentials between regions are becoming less significant when weighed against the total cost of production (including transportation and logistical obstacles). The shift toward Asian manufacturing is expected to continue, but not be disruptive.

In 2021, the NVR report profiled 102 large CM companies ($100 million+ in revenue) dominated by the computer, communications, and consumer market segments, while medium-sized and small CM

Table 1 ranks the top ten EMS companies by revenue for 2021. Foxconn continued its extraordinary dominance as the leading EMS firm in the industry, outdistancing its closest contender by more than four times. The top ten leaders all account for 74.5 percent of total industry production revenue.

| Table 1 – Top Ten EMS Company Market Share, 2021 | ||

| Company | Revenue ($M) | Share |

| Foxconn (Hon Hai) | 214,563 | 39.5% |

| Pegatron | 45,235 | 8.3% |

| Wistron | 30,859 | 5.7% |

| Jabil | 30,020 | 5.5% |

| Flex | 25,456 | 4.7% |

| Luxshare Precision | 23,865 | 4.4% |

| BYD Electronics | 13,806 | 2.5% |

| Universal Scientific Ind. | 8,575 | 1.6% |

| Sanmina | 6,759 | 1.2% |

| New Kinpo Group | 5,788 | 1.1% |

| Others | 138,712 | 25.5% |

| Total | 543,638 | 100.0% |

The Worldwide Electronics Manufacturing Services Market – 2022 Edition is over 600+ pages in length, and examines the leading EMS and ODM suppliers across 57 countries, 46 product industries, and more than 900 manufacturing locations. For more information, contact Karen Williams at New Venture Research at 408‐888‐5667 (kwilliams@newventureresearch.com) or visit www.newventureresearch.com for more details.