Semiconductor Supply Chain Outlook: Seeking Alpha

Summary

- Semiconductor supply chain activity is expected to reach an upward inflection point in 2024.

- Macroeconomic data suggests a continued downturn in demand for electronics equipment and computer chips.

- Consensus earnings forecasts indicate a recovery in revenue starting in the fourth quarter of 2023 and accelerating in the second quarter of 2024.

Semiconductors lie at the heart of supply chains ranging from computers and phones to autos and manufacturing equipment. Activity in the sector can be a guide to wider supply chain activity — indeed the shortages of chips during the pandemic were emblematic of how supply chains can fail under stress.

Analysis of the semiconductor industry using supply chain, macroeconomic and financial data as well as review of 38 companies’ comments — augmented with NLP analysis of earnings transcripts — shows an upward inflection point in supply chain activity is close but would not fully arrive until well into 2024.

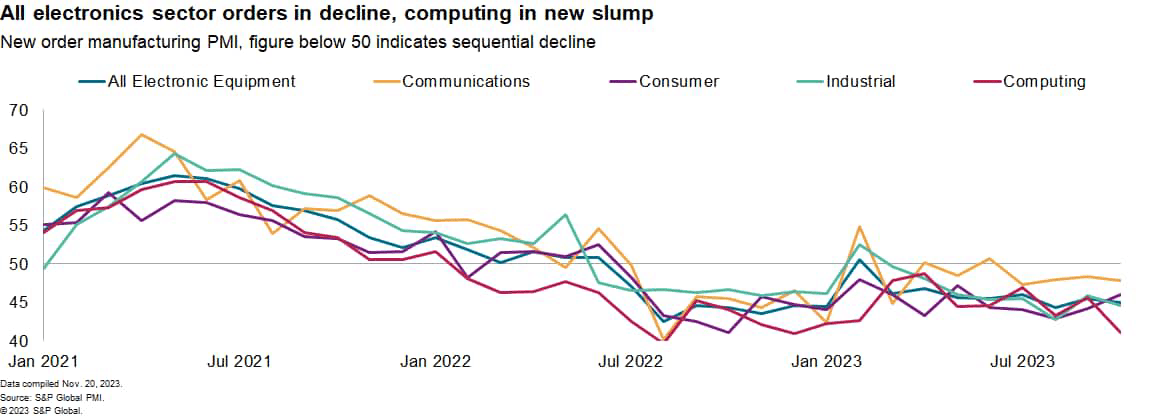

Macroeconomic data suggests the downturn in demand is still ongoing. The S&P Global PMI for electronics equipment orders continued to decline in 15 of the past 16 months while exports of computer chips from the largest four exporting regions fell by 9% in October.

On a brighter note, consensus earnings forecasts indicate a recovery in revenue from the fourth quarter before accelerating to 10% in the second quarter of 2024 for most companies.

The large computer and phone producers are seeing a stabilization in demand during the fourth quarter of 2023 with a recovery in early 2024. The connected devices and peripherals sector is still in a recovery phase, with a stabilization in the final quarter of 2023 including inventories, which are ending a period of downward correction. Growth in 2024 is in part reliant on new products as well as a renewal cycle for equipment bought during the pandemic era.

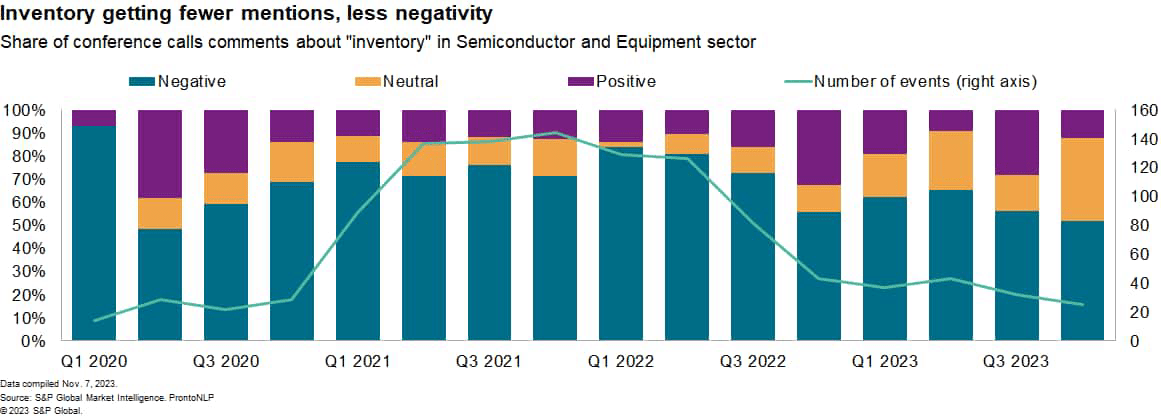

The decline in demand for chips has been accompanied by a run-up in inventories. Several firms expect a recovery in demand to help offset the higher inventories. NLP-based analysis of earnings call transcripts shows the proportion of firms making negative statements about inventories fell to 52% in the fourth quarter of 2023 from 84% in the first quarter of 2022.

A detailed review of comments by over 20 semiconductor-producing firms shows many of the companies — both in production and fabless models — expect demand to only catch up with supply and inventories in 2024.

The downturn in demand from the electronics sector can also be seen in the exports of semiconductors from the big four exporting regions of mainland China, Taiwan, South Korea and Japan. Exports from the four combined fell by 9% year over year in October 2023 according to Market Intelligence data, similar to the 7% drop in September and 10% decline in August. That supports the evidence from the PMI data for electronic equipment purchases and may indicate a recovery from the slowdown has stalled.

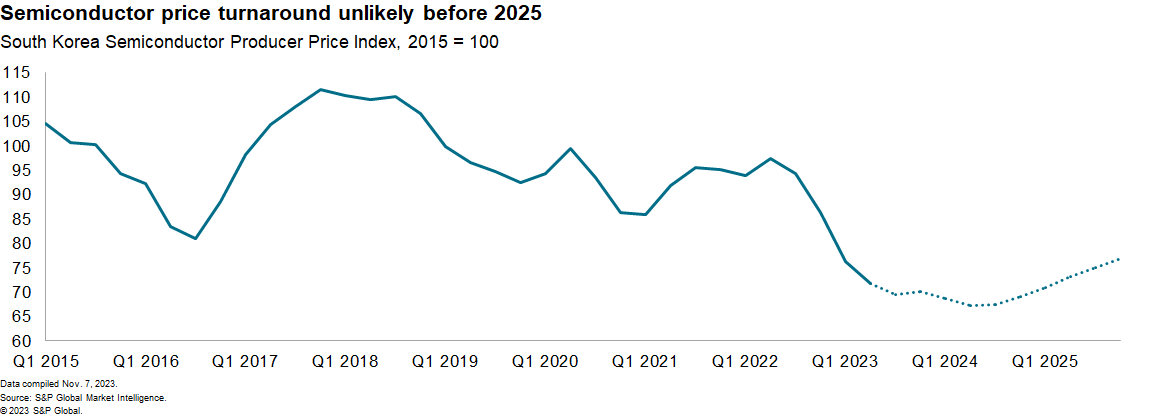

The manufacturers of memory chips and storage devices have experienced the deepest downturn over the past two years because of the decline in demand for consumer applications including computers and phones. That can be seen most keenly in South Korea, where 55% of semiconductor exports were accounted for by memory chips in 2022, Market Intelligence data shows. Average South Korean semiconductor prices fell by 29% in the third quarter of 2023 versus the second quarter of 2022. They are expected to fall further in 2024 before recovering in 2025, Market Intelligence estimates show.

Suppliers of chemicals and bonding materials to the semiconductor sector have suffered from a period of destocking, which has now stabilized with some signs of growth returning. Global exports fell by 12% year over year in September, according to Market Intelligence data, but the export restrictions noted above may not have a noticeable effect in the aggregate given their limitation to the highest end graphics processors.

Chipmaking equipment firms expect orders and sales to restart only cautiously during 2024 as they attempt to hurdle geopolitical challenges, as outlined in Time, tariffs and tracking: Fourth quarter 2023 supply chain outlook.