Sales, Orders and Production Growth Drive Overall Continuing Industry Health and Optimism, But 2nd Quarter Results Indicate Short Term Bumpiness

By Sharon Starr, IPC Director, Market Research

Sharon Starr

Since IPC launched the quarterly Pulse of the Electronics Industry survey in mid-2017, respondents’ quarterly sales growth has been positive in each of the last eight quarters. The 145 respondents to the second-quarter 2019 survey projected average sales growth of 7.4 percent this quarter.

The current state of the industry is solidly positive on balance. Of the key factors that are measured to assess the current state, sales and order growth are the strongest positive drivers of the current business environment in all regions, industry segments and company size tiers. Labor and material costs and recruiting challenges have been the primary negative influences on the business environment.

In the regional segmentation of responses on the current state, global businesses report the strongest current-state indicators in aggregate, followed by businesses in the Americas and then in Europe. Only the Asia Pacific region averaged a negative current-state score this quarter, which was heavily driven by rising labor costs.

Profit margins are a positive influence on the current environment this quarter for all industry segments except materials suppliers. Margins are moving in a positive direction for all company size tiers, especially those representing companies with annual sales of more than US$100 million. A regional segmentation shows, however, that weakening profit margins are among the factors negatively affecting the current business environment for the reporting companies in Asia and Europe.

The industry’s outlook for the next six months is solidly positive overall, driven primarily by expected growth in sales, production, markets and capital investment. All indicators factored into the six-month business outlook are positive drivers in all regions, with the exception of exports. Exports this quarter were rated as moving in a negative direction in Asia and neutral in Europe, reflecting the current trade disputes and new tariffs. The export rating was strongest for the global businesses. Overall this quarter, global businesses gave the strongest ratings to the factors affecting the outlook for the next six months.

The industry’s outlook for the next 12 months is equally robust overall, with 83 percent of second-quarter 2019 survey respondents describing the 12-month business outlook as positive. The outlook is solidly positive in all regions, although for the last two quarters the outlook of respondents in Asia has been the weakest of the regions. The outlook is strong in all industry segments, most particularly for OEMs.

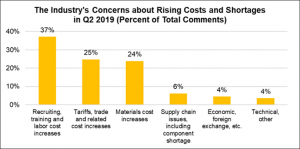

IPC’s second-quarter 2019 Pulse of the Electronics Industry survey results indicated a bump in the positive impact of economic and market conditions. Sixty-one percent of the respondents’ open-ended comments about what is driving industry growth cited economic, market or demand growth. Some of these comments mentioned the impact of tariffs and reshoring. On balance, however, trade and tariff issues were far more often cited as conditions that are increasing costs and limiting growth. Among negative impacts on the industry, trade and tariff issues are second only to labor force issues.

Pulse of the Electronics Industry is a data service that IPC developed in response to members’ need for greater visibility into the health of the electronics industry and the direction in which the business environment is moving. Its purpose is to generate timely insights on the current state of the electronics industry and its near-term outlook. The findings are based on data collected from people in management at manufacturing companies and their suppliers in all segments of the electronics industry worldwide.

The quarterly reports are free to those who complete the survey. They are available to others by subscription in IPC’s online store. Information about this program is available by contacting IPC’s market research team at marketresearch@ipc.org or +1 847-597-2868

The third-quarter survey is now online and open until July 19.