Raw Materials or Passive Components: June 2019 Outlook

Originally published on TTI’s MarketEye Blog

Dennis Zogbi

Paumanok Publications, Inc. estimates the value of primary materials consumed as dielectrics, electrodes and terminations at USD $10 billion worldwide in 2019 in the global fixed passive electronic component industry. Capacitors represent 70 percent of electronic materials demand, with 30 percent going toward resistors, magnetics, sensors and circuit protection.

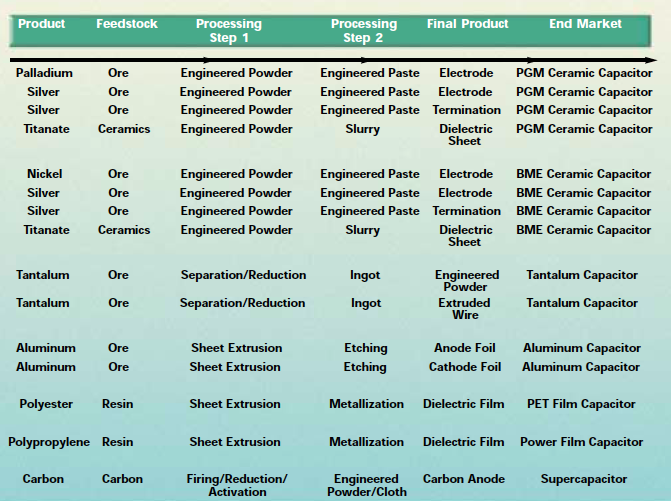

Figure 1.1 (below) illustrates the various raw materials consumed in the production of capacitors worldwide. Feedstocks for capacitors include metals, ceramics, plastics and carbon, beginning in the form of ores or resins and transformed into powders, pastes and sheets before being consumed as finished capacitors for bypass, decoupling, filtering and burst power circuits in modern electronics. With trillions of pieces produced each year, materials consumption is moderate in terms of volume, but extremely consistent and profitable for miners and chemical processing companies.

In an attempt to achieve desired surface area and capacitance, manufacturers use one of three methods – stacking, winding or pressing – to maximize passive component functionality for portability in modern electronics. The active surface area of the materials described is created by advanced-engineered raw materials processing, primarily milling, etching and metallizing.

How Materials Impact Production Costs

Raw materials impact the overall costs of producing passive electronic components. In fact, dielectric materials, electrode materials and termination materials represent the largest variable cost associated with the production of electronic components.

Any fluctuation in price or availability for these key feedstocks can have a negative impact on profit margins for electronic component producers, but seldom do component manufacturers or their OEM and EMS customers have long-term visibility of the various sub-levels of the supply chain.

Figure 1.1: Primary Raw Materials Consumed in the Capacitor Industry, 2019

Ceramic Metallization and Dielectric Materials

Ceramic capacitors employ metals in electrodes and terminations. Because of the specialty nature of the metals consumed, these represent a significant segment of materials demand in passive components in 2019.

The multilayered ceramic chip capacitor (MLCC) market represents the largest subset of materials vendors in dollar value and profitability. This market is divided into Platinum Group Metals (PGM) and Base Metal Electrodes (BME). Electrode materials include palladium, palladium + silver (PGM), nickel or copper (BME); termination materials include silver (PGM) or copper (BME).

The dielectric materials consumed in ceramic capacitors are based primarily on barium carbonate and titanium dioxide compounds, which are mixed to form barium-titanate and a variety of other ceramic-based dielectric matching systems. When mixed with additives, the ceramic dielectric material is converted into a composition or formulation that communicates the performance characteristics of the finished capacitor to the electrical engineer – for example, X5R, X6S, X7R, Y5V and COG are all chemical formulations.

The variable in chemical matching systems may ultimately be determined based upon the finished capacitor’s requirement for capacitance stability vs. temperature. The trend over the last decade has been to modify the ceramic composition to allow for capacitance in a smaller chip case size. This sacrifices performance with temperature, voltage handling capability, ESR, IR and DF; the design engineer must justify this for the higher capacitance value.

PGM Ceramics

PGM ceramic capacitors are those with electrodes made from PGM, containing palladium (i.e. legacy MLCC, since PGM is what the industry was founded on in Japan, Germany, France and the U.S.). PGM ceramic capacitors will have either 100 percent palladium electrodes, 70 percent palladium electrodes or 30 percent palladium electrodes, or a variation of the loading (with as little as 10 percent loading reported at one vendor) with silver as the balance.

The terminations employed in PGM ceramic capacitors are predominantly silver electrodes, although a small percentage of ceramic capacitor terminations include palladium + silver and platinum + terminations.

Ceramic dielectric materials consumed in PGM ceramic capacitors are typically solid-state ceramic materials, and some variation on the barium carbonate + titanium dioxide theme. Primary raw materials consumed in the production of PGM ceramic capacitors account for 60 percent of the total value of the worldwide PGM ceramic capacitor market.

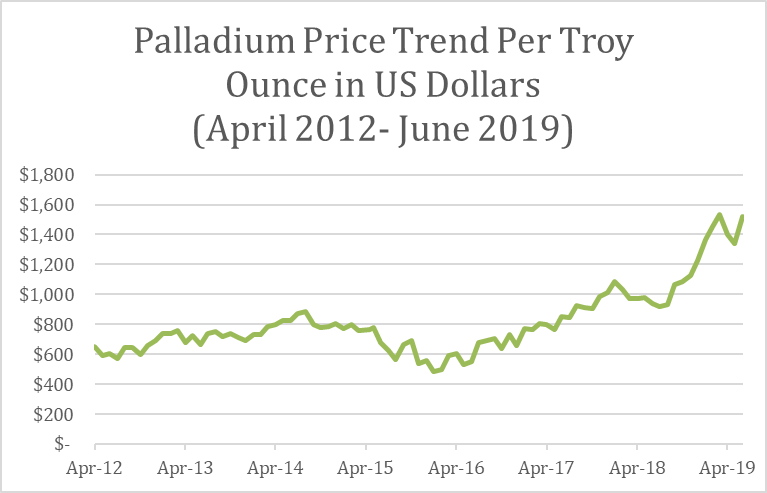

This is, of course, the result of the extraordinary price of palladium in 2019, which is almost twice what it was 24 months ago at USD $1,500 per troy ounce, and represents up to 50 percent of the cost of the PGM ceramic capacitor in high-fire systems.

This cost is quite prohibitive and totally noncompetitive against ceramic capacitors produced with base metal electrodes such as nickel, which dominated the lucrative high-capacitance portion of the MLCC business in 2017 and where the bottleneck in production has caused worldwide extensions of lead times. Such pricing urges greater BME MLCC development.

The outlook for PGM ceramic materials (which are ultimately consumed in mission-critical applications, such as automotive under-the-hood, aerospace, medical, oil and gas, satellites and infrastructure) is that costs will increase in accordance with the volatility of palladium electrode materials and silver terminations. These markets that are controlled by the outcome of other markets – most notably the catalytic converter markets in automobiles.

Most recently, and in accordance with this MarketEYE story, metals processors in PGM were curious why PGM consumption in passive components had increased in FY 2019 and why this was not forecast by the industry. In fact, the opposite was forecast, and it is this change in forecasting that is creating volatility in metals in June 2019.

Palladium Price Trend, 2012-2019: Palladium is a platinum group metal mined in Russia and South Africa, among other locations; it is consumed primarily for auto-catalysts, but also for jewelry. It is the primary electrode material in precious-metal based MLCCs which are, in turn, used in high-reliability, high-temperature and high-voltage product markets globally.

Palladium has exhibited extreme price volatility between 2012 and 2019, with its price in June 2019 at a five-year high. High feedstock pricing impacts production costs for MLCC manufacturers, which is the primary motivating factor behind the movement to nickel electrodes in many end-markets where it has not been used before (such as defense, space, and oil and gas electronics).

Figure 1.2: Palladium Price Trend: 2019

Source: Paumanok Monthly Report On Passive Electronic Components-June 2019

For more information, contact Dennis Zogbi at Paumanok Publications, Inc., dennis@paumanokgroup.com.