Opportunities in the Greek Solar PV Market

Opportunities in Greek solar PV market

By Pradeep Chakraborty

The Greek solar market took off in 2006 when feed-in tariffs (FiTs) were introduced for PV, said Stelios Psomas, Policy Advisor, Hellenic Association of Photovoltaic Companies (HELAPCO). He was speaking at a webinar held recently on the solar PV market in Greece, organized by Solarplaza.

There were simple authorization procedures in 2010, followed by a market boom during 2011-2013. Years 2013-14 saw retroactive FiT cuts and freezing of new projects. In 2016, tenders were introduced and there was the first pilot tender. Now, in 2018, we are seeing tenders becoming the norm, and costs going down.

There have been some remarkable figures. Now, 7 percent of the electricity demand in Greece is covered by PV, bringing Greece to the third place worldwide with regard to PV contribution to electricity needs. Greece ranks 5th worldwide with regard to the installed PV capacity per capita. About €5 billion has been invested in PV so far in Greece.

Despite the retroactive cuts back in 2014, project returns remained high for asset owners, and the bankability of their projects remained intact. In fact, even after the FiT reductions, the PV market in Greece has the lowest non-performing loan track record (there are practically no NPLs in the sector).

Regulatory risks have been eliminated. As on June 16th, 2016, the Greek Government agreed on a supplementary MoU with its creditors, which tried to put an end to the previous uncertainty. According to this MoU: “By June 2016, the authorities will: (iii) as a milestone amend the current legislation on ETMEAR and/or the structure of the RES account while respecting existing contracts in line with European Union rules, to ensure that the debt in the RES account is eliminated over a 12-months forward looking horizon (not later than June 2017); the account will be kept annually in balance onward”.

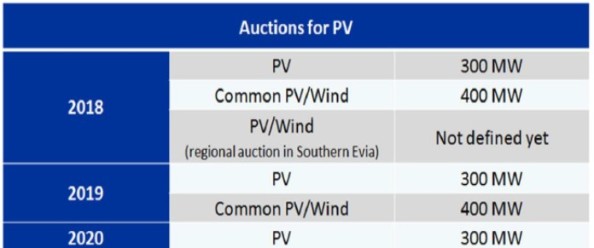

The RES account had a surplus by the end of 2017, and is expected to be kept in balance from now on. A long-term energy planning is underway now in Greece. The preliminary target for PV till 2030 is 6-6.5 GWp. This translates to an average annual market of 300 MWp.

A new support scheme for renewable energy, consistent with the guidelines on State aid for environmental protection and energy 2014-2020 (based on competitive tenders and feed-in-premiums) was introduced in 2016. A pilot auction for 40 MWp took place in December 2016, and another one on July 2nd, 2018.

Results of latest auction (July 2nd, 2018)

Category Ι (<1 MWp)

* 83 projects approved (total capacity 53. 5 MWp)

* Min price: 75.87 €/MWh

* Max price: 80 €/MWh

* Avg. price: 78.4 €/MWh

Category Ι I (>1 MWp)

* 8 projects approved (total capacity 52.9 MWp)

* Min price: 62.97 €/MWh

* Max price: 71 €/MWh

* Avg. price: 63.8 €/MWh.

The next auction is due for Q4-2018.

Pre-qualification criteria for tenders

Although in the future RES projects at an earlier stage of development might be eligible to participate in tenders, RAE (the competent authority for auctions) has ruled that for the 2018 rounds, all project owners must have secured a Production License (required for systems >1 MWp)) and a Connection Agreement or a Final Grid Connection Terms Offer, both in force.

In the event that a legal entity or natural person owns more than one RES plants for which it submits additional applications, it can participate in the auction by submitting an application for each station separately via the certification and subscription to the e-platform as a separate user.

For the purpose of ensuring satisfactory levels of competition, a 75 percent Competition Surplus rule applies. More specifically, the sum of the capacity of all participants included in the ‘Final List of Participants’ must exceed by 75 percent the tendered capacity of each category.

Participation fees, bid bonds and performance bonds

Applicants must also pay a participation fee and submit a Bid Bond. The participation fees are: €500 for PVs up to 1 MW; ii) €1,000 for PVs from 1 MW and up to 20 MW

The Bid Bond is set at €10 per kW of installed capacity. If a participant is not successful in the auction, the Bid Bond shall be returned to them upon issuance of RAE’s decision on the final results of the Tender Process.

The Performance Bond is intended to ensure that the project is installed and starts operation within the deadlines set by RAE.

The 4 percent Bond Value: The sum of the bonds submitted to RAE by the participant for the specific project in the context of the Tender Process must be equal to 4 percent of the total investment, taking as a calculation base an estimated installation cost of €1,000/kW.

Deadlines for completion of projects

* 12 months for PV systems with a capacity PPV ≤ 1 MW

* 15 months for PV systems with a capacity 1 MW < PPV ≤ 5 MW

* 18 months for PV systems with a capacity 5 MW < PPV ≤ 20 MW

A six-month additional extension to each one of these deadlines is provided for those projects connected to the grid via a substation. Greek banks offer the following terms for PV financing:

* Long-term loan up to 70 percent of the investment cost.

* Tenor: 10-14 years.

* Interest rate: 4-5 percent (including fees).

Panagiotis Sarris, GM, Solar International at ABO Wind AG, added that for Greece, ABO Wind has a long-term perspective. Wind and solar technology, eventually hybrid and storage. Greenfield development and acquisition of mature project rights. It has significant RES capacity, and high spot market electricity prices and liberalization are almost completed.

As for challenges in Greece, the financing conditions are far from European standards (leverage and interest levels, pay-back period). Investors and banks are still reluctant to proceed (country risk, phase out of FiTs). There are long-lasting licensing procedures. Various opex parameters are still undefined (balancing, levies, taxation etc.). Local developers and land owners are still living the euphoria of high FiTs. Also, environmental legislation is under revision.

Licensing process should be reviewed and simplified to accelerate project maturing.

It prescribes steps that have eventually become of limited importance (e.g., given the strong role of RAE at the auctions, PL processes could be easily integrated in subsequent development steps).

It currently consists of numerous amendments, which are difficult to follow, many times contradictory and/or irrelevant to current status (e.g. the different types of securities prescribed could be integrated under a single scheme). Deadlines should be prescribed, forcing authorities to review applications without unreasonable delays.

As for the auction system, various rules and parameters of the process should be reviewed and amended accordingly. Duration (time extension should be prescribed in case of hit during the last e.g. 15 seconds). Priority (larger projects with low offers should be allowed to secure a tariff even if the remaining capacity is insufficient).

Oversubscription (75 percent level should be lowered, given the low number of mature projects). Auctions for immature projects should be prescribed for the non-awarded capacity (combined with a fast track licensing process for successful bidders).