North America Electronic Component Sales Sentiment Sustains Positive Growth Outlook, Reports ECIA

ECIA’s Electronic Component Sales Trend (ECST) May and Q2 2022 Survey Results

By Dale Ford, Chief Analyst

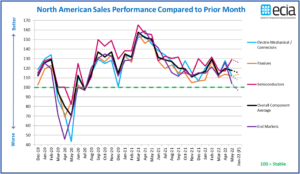

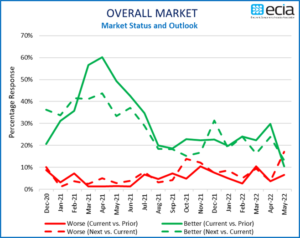

The results of the May 2022 Electronic Component Sales Trend Survey (ECST) continue to show positive growth expectations despite strong economic headwinds. The overall average sales sentiment for May registered at 117.6, six points about the outlook projected last month. Over the past nine months, starting in September 2021, overall average sales sentiment has tracked within a nine-point range of 111 to 120 except for February when it surged up to nearly 130. All major component categories have achieved solid, positive sales sentiment during this time with Semiconductors demonstrating the highest overall sentiment of 123.1 during this period and Passives coming in with the lowest average of 112.5 – less that ten points separating the highest and lowest. Survey participants continue their positive assessment for component growth with the index only dipping slightly to 115.4 for June. This dip is driven primarily by weaker Electro-Mechanical growth expectations. The end-market outlook presents an interesting anomaly in the overall picture. In assessing June prospects, the overall sentiment drops below 100 to 96.1. However, the average of the individual market outlooks comes in at 107.8 with only the Compute and Consumer Electronics categories dropping below one hundred. It would appear that there is a general sense of concern about the impact of the economy on the market while judging specific end markets still yields more hopeful expectations.

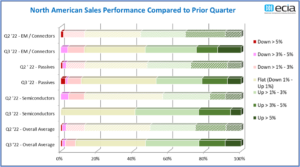

The medium-term outlook measured by the Quarterly ECST paints a solidly positive picture through Q3 of this year. Over half of respondents report expectations of growth in Q2 and Q3 with roughly 25% expecting growth above 3%. An average of only 13% see a decline in Q2 and that drops to 9% in Q3. Expectations for Semiconductor growth jump significantly in Q3 as expectations of growth improve from 43% in Q2 to 59% in Q3. Nobody saw any possibility of a decline in Semiconductor sales in Q3. This is an encouraging result given several prognostications by industry analysts that the semiconductor industry would experience a precipitous decline in 2022. In contrast to Semiconductors, Passive and Electro-Mechanical sales sentiment becomes slightly more conservative in Q3 compared to Q2 – but still very positive overall.

As noted previously, the overall end-market index delivers a result that is inconsistent with both the component views as well as the sentiment of the individual end-markets. On the positive side, Avionics/Military/Aerospace continue to see improving sales expectations. Perhaps this is not surprising given events around the world. Industrial Electronics and Automotive Electronics also deliver very positive expectations. Telecom Networks and Medical Electronics see a drop in sales expectations while Consumer Electronics maintains a mostly flat outlook. Mobile Phones and Computers continue to see declining sales in the index with results well below one hundred for a number of months now. The outlook for Mobile Phones improves modestly to a flat outlook for June.

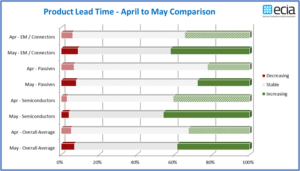

Expectations of increasing Product Lead Times in May compared to April jumped significantly across all major component categories. An overall average of 39% saw increasing lead times in May with only 7% seeing a decline in the average. The most painful view comes from Semiconductors with 46% seeing an increase in lead times. Passives had the most hopeful view with 28% seeing longer lead times. However, that is up from 22% in April. The lead time pressure results mirror the sales growth expectations between Semiconductor and Passive components. The combination of solid end-market demand and supply chain challenges are continuing to stress the lead time expectation.

The ECST survey provides highly valuable and detailed visibility on industry expectations in the near-term through the monthly and quarterly surveys. This “immediate” perspective is helpful to participants up and down the electronics components supply chain. In the long-term, ECIA shares in the optimism for the future as the continued introduction and market adoption of exciting innovative technologies should motivate both corporate and consumer demand for next-generation products over a growth cycle that still appears to have legs to go an extended distance.

The complete ECIA Electronic Component Sales Trends (ECST) Report is delivered to all ECIA members as well as others who participate in the survey. All participants in the electronics component supply chain are invited and encouraged to participate in the report so they can see the highly valuable insights provided by the ECST report. The return on a small investment of time is enormous!

The monthly and quarterly ECST reports present data in detailed tables and figures with multiple perspectives and covering current sales expectations, sales outlook, product cancellations, product decommits and product lead times. The data is presented at a detailed level for six major electronic component categories, six semiconductor subcategories and eight end markets. Also, survey results are segmented by aggregated responses from manufacturers, distributors, and manufacturer representatives.