Latest ECIA COVID-19 Survey Update Shows Increasing Concerns in Spite of Relative Stability

Coronavirus Survey – Update 10

Results of Manufacturer & Distributor Survey Ended August 17, 2020

By Dale Ford, Chief Analyst, ECIA

Dale Ford, Chief Analyst, ECIA

Developments over the past month on “Main Street” and “Wall Street” have revealed the triumph of hope (and a lot of government stimulus money) in battling the devastating economic impact of the Coronavirus / COVID-19 pandemic. Frightening levels of unemployment have seen dramatic improvements as the U.S. unemployment rate fell to 10.2% in July from a peak of 14.7% in April. The U.S. economy added 9.3 million non-farm payroll jobs over a three-month period from May to July 2020. The stock market indices have moved back into record territory with the NASDAQ reaching new all-time highs and the S&P 500, where technology giants that make up a disproportionate share of the index, closing at its highest level ever on August 18. Just 126 trading days elapsed from the last peak achieved by the S&P 500 and marks the index’s fastest-ever recovery from a bear market. In the manufacturing sector, the ISM Purchasing Manager’s Index (PMI) registered 54.2 in July 2020, a figure that indicates expansion in the overall manufacturing sector for the third month in a row after a contraction in April.

In spite of the recent favorable economic developments, fears continue to impact the economy as a “second wave” of reported cases lead to the renewed closure of many businesses and almost all schools starting the school year with “distance learning” programs. The challenges of the pandemic continue and present complex issues for government and business leaders.

The health of the electronics components supply chain as measured by ECIA’s most recent survey of electronics components manufacturers and distributors reflects the continuation of relative stability and hopeful economic uncertainty even while concerns have increased in many sectors of the supply chain and segments of the market. Electronics component revenues in the first half of 2020 were much more solid than originally feared and reasonable expectations for the second half remain. However, the ability to manage the pandemic continues to be an ever-present factor for supply chain managers as they look forward.

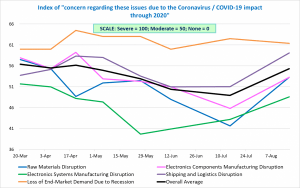

Survey responses across a range of measures show a significant jump in concerns regarding the health of the electronics components supply chain. While concerns about end-market demand remain high, the index of concern regarding raw materials disruption, shipping and logistics disruption and electronics components production jumped from their lowest levels measured in July back to the peak levels last seen in April and May. Concerns regarding electronics systems manufacturing continued to increase from the lows seen at the end of May

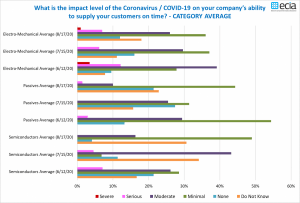

In contrast to concerns reported about the supply chain, the index for the impact of COVID-19 on the ability to supply passive components and semiconductors on time saw a significant reduction and electro-mechanical components only increased slightly since the latest survey. There continues to be some cognitive dissonance in the survey results between the impact on “on-time “delivery and the overall trends for increased lead times due to COVID-19. The index for all three major component categories registered a notable jump in expectations for increased lead times.

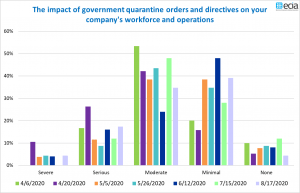

On the question about the impact of government quarantine orders on a company’s workforce there was a meaningful shift from “moderate” to “minimal” impact as the most common response. However, the increase in those reporting “severe” and “serious” impact along with the decrease in those reporting “no impact” resulted in an increase in the overall index measuring workforce impact

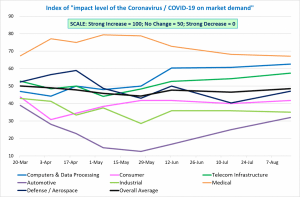

The outlook for individual end markets saw automotive electronics continue its rebound from very depressed levels. Every end-market saw improved expectations for demand to one degree or another with the exception of industrial electronics and medical electronics. The brightest outlooks for end-markets continue to be found in medical electronics, computers & data processing, and telecom infrastructure. Confidence in order backlog consolidated around “Average” confidence levels for all three major component categories in the most recent survey. Between 70% and 78% reported “Average” confidence overall in the three component segments – a retreat from notable shares at “Strong” and “Very Strong” confidence levels reported in prior surveys. Still, the survey results for end-market demand expectations seem to be setting a reasonably positive platform for electronics component demand as we continue through the second half of 2020.

ECIA began conducting surveys of member manufacturing and distributor companies at the start of February to provide visibility on the ever-evolving impact of COVID-19 on the electronics components supply chain. It has been one month since the last ECIA survey focused on the impact of COVID-19 on the electronics components supply chain. This most recent survey was conducted between Monday, August 10th and Monday, August 17th.