June ECST Electronic Components Sales Sentiment Disappoints but Optimism Returns in July Outlook

|

ECIA’s Electronic Component Sales Trend (ECST) June 2024 Survey Results

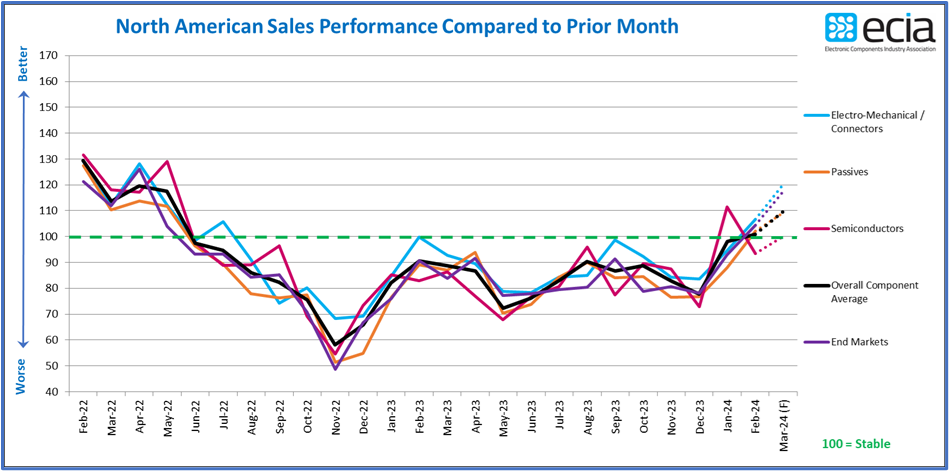

Atlanta — For the second month in a row, the ECST survey delivered disappointing, declining results as the overall component index fell by 13.4 points in the June survey to slip below the 100-point threshold down to 98.9 points on the index. The combined decline of over 25 points across May and June erased all upward progress that had been achieved since the start of the year in January. “Once again, survey respondents expect a rebound in July with the outlook calling for an improvement of 13 points, recovering to 111.9,” explained ECIA Chief Analyst Dale Ford. “However, after two consecutive months of major forecast misses, confidence in this outlook is shaky at best. Market sentiment for the first half of 2024 has essentially been reset to where it started the year. Hope for 2024 is still found in the expectation coming into 2024 that growth for the year would be driven by second half performance. |

|

|

For the complete summary report, click here. Members can log in to view the entire report here. The ECST survey provides highly valuable and detailed visibility on industry expectations in the near-term through the monthly and quarterly surveys. This “immediate” perspective is helpful to participants up and down the electronics components supply chain. In the long-term, ECIA shares in the optimism for the future as the continued introduction and market adoption of exciting innovative technologies should motivate both corporate and consumer demand for next-generation products over the long term. The complete ECIA Electronic Component Sales Trends (ECST) Report is delivered to all ECIA members as well as others who participate in the survey. All participants in the electronics component supply chain are invited and encouraged to participate in the report so they can see the highly valuable insights provided by the ECST report. The return on a small investment of time is enormous! The monthly and quarterly ECST reports present data in detailed tables and figures with multiple perspectives and covering current sales expectations, sales outlook, product cancellations, product decommits and product lead times. The data is presented at a detailed level for six major electronic component categories, six semiconductor subcategories and eight end markets. Also, survey results are segmented by aggregated responses from manufacturers, distributors, and manufacturer representatives. Non-members can now purchase the ECST report at https://www.ecianow.org/purchase-reports. |