France’s solar market ready for international business

France is now one of the top seven global solar markets and the world’s largest issuer of green bonds. France’s new energy strategy outlined on Nov 27, 2018, will increase solar capacity five-fold by 2030. The EU has approved 600 million EUR ($679 million) in funding for innovative solar power installations.

Damien Ricordeau, founder and CEO, Finergreen, said electricity generation in France had been 529 TWh produced in 2017. Nuclear comprised 72 percent, while thermal and hydro accounted for 10 percent, each. Wind had 5 percent, while solar and bioenergy had 2 percent, each. He was speaking at a seminar titled: “Is France’s solar market ready for international business”, in Paris, France, organized by Solarplaza.

New directives from the French government indicate that there will be shutting down 14 nuclear reactors up to 2035. The generation mix in 2035 should have 50 percent from renewable energy sources. This demonstrates France’s clear ambition to develop renewable energy capacity.

The European ranking for solar installed capacity, as of the end of 2017, had Germany at No. 1, followed by Italy, the UK and France, respectively. The forecasted additional capacity for France has been estimated at 11.9GWp between 2018-2022. In the forecasted capacity at the end of 2022 (GWp) and the European solar market share, France is placed No. 3, behind Germany and Italy.

Evolution of French solar capacity

Let’s look at the evolution of the French solar capacity with the government’s objectives. The situation in Nov. 2018 was 8.4GW. The objective for 2023 is 21GW, with +2GW added each year. It moves up to 40GW in 2028, with +3GW added each year. These are ambitious objectives for solar energy in the coming years in France to move one step further in terms of the installed capacity.

The French electricity mix in 2028, with PPE objective, is over 600TWh production. Renewables share increases from 20 percent in 2020 to 36 percent in 2028. While hydro capacity will remain constant, wind and solar capacities will soar, and push forward the renewables electricity share. Around 10 percent of the French electricity should be produced via solar PV. New tenders will be launched soon to accelerate the French solar capacity and try to match the objectives.

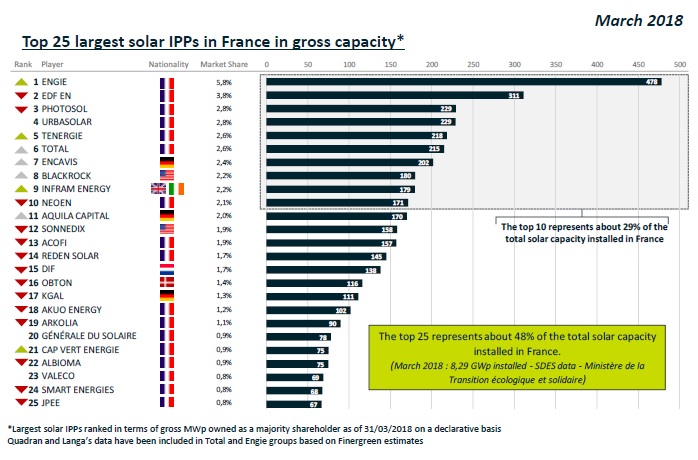

The French solar market is also consolidating. Companies are pulling their strengths together. As of now, the top 25 largest solar IPPs in France represent about 48 percent of total solar capacity installed in France. The top 10 solar IPPs represent about 29 percent of the total solar capacity installed in France.

Organic growth

This involves, starting a business from scratch on the French solar market. In pros, first, no acquisition is required, hence, less expensive strategy. There is independence and easier decision process as no partners/co-investors are present. Finally, there is flexibility and trust in the team deployed from the head office.

As for cons, there is administrative complexity in the French project development process (7 to 10 years to develop a wind park). There are no feedbacks on market insights, which means it is time to adopt a strategy. Lastly, local presence and culture, a must have especially for development, and difficulty to recruit skilled people.

For instance, CGN Europe Energy, a Chinese state-owned company, demonstrates a growing learning curve and a better understanding of this new market. ib vogt GmbH is a German integrated developer and IPP. It plans to develop 800MWp total solar capacity in France by 2025.

Asset-oriented external growth

This involves acquiring project pipeline or assets, rather than entire companies. In pros, there are benefits from the local counterpart’s experience and knowledge in the projects it developed, built and operated. The liquidity of the second-hand French solar market permits a quick penetration of the market without any commercial risk. To benefit, form a critical size from the beginning to structure an efficient organization.

As for cons, it is a very expensive strategy to buy assets, which can only deliver low financial returns in a very competitive market. There is higher risk in the development pipeline acquisition, which can’t win tenders, without hiring the local team. The main objectives are to acquire a development pipeline, and to acquire producing assets.

Company-oriented external growth

This involves acquiring a local company to expand on the French solar market. In pros, there is quick integration of skilled people + pipeline / portfolio of projects. So, the critical size is ready to

operate. Also, the ongoing business of the acquired company, ensuring short- and mid-term activity. There is less competition in corporate deals than in assets deals.

In cons, the key is finding the right partner in a double culture world. Processes can be long and costly with due diligences and strong negotiations. Integration of employees, sometimes causing double employment or simply, no staff commitment.

Finergreen’s advice

For the organic development of solar projects, Finergreen advises to recruit local professionals, especially developers, who have the experience of the French solar market.

For the asset-oriented external strategy, Finergreen advises to diversify your portfolio with different assets in terms of project completion stages — under development, under construction, or operating.

For the company-oriented external strategy, Finergreen advises to take your time and identify the right targets. It calls for integrating the new business models and employees.