Five Predictions for EMS Industry in Asia Post-Covid

By Derrick Zhao, Supply Chain Resources Group(SCRG)

Trade tensions and the Covid-19 pandemic have been a one-two punch for the EMS industry in Asia. Here are five predictions for how it will sort out in 2021 and beyond.

Beginning in early 2017, the Trump administration began making threats of tariffs on Chinese imports. In March of 2018, the administration enacted its first of three rounds of tariffs that eventually covered a wide range of Chinese exports including many produced by the country’s 4,500 plus EMS companies.

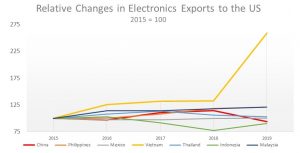

With the enacting of the major tariffs announced in September of 2018, my team at SCRG China started to see some activity on the part of our US customer base in China. Roughly 25% of our US customers began either investigating or taking specific actions to reduce their dependence on Chinese manufacturing. Although to date not a single one of our US customers in China has actually exited their contract manufacturing relationships in China, about 20% have taken some actions to reduce the China concentration of their manufacturing footprint. Additionally, we have engaged with a few new customers who have retained SCRG to help them find suppliers outside of China in other place where we operate, such as Vietnam, Thailand, Malaysia, Mexico and India. An analysis of US imports of electronics since the beginning of the trade war clearly shows that the biggest beneficiary of the US/China trade tensions has been Vietnam, and those EMS companies that had been developing operations in Vietnam going back 7 to 10 years.

Source: U.S. Customs

Relative change in export of electronic products to the US, 2015 – 2019

These global macro data are completely consistent with SCRG’s experience as our fastest growing services location over the past 18 months has been Vietnam.

The growth of EMS locations like Vietnam and Mexico, has been primarily driven by OEMs’ desire to diversify their supply chain to mitigate risk. China remains, by at least an order of magnitude, the largest EMS destination in the world, and this is unlikely to change over the next decade. In a recent interview with our founder Ron Keith on Made-In, Mike McNamara, Chairman of the Board of PCH International and long-time CEO of Flex was asked if companies can move their supply chains out of China quickly. McNamara said, “The answer is no… [China’s] sub-component supply chains, distribution systems, and logistics, have been built up and created an efficiency around the supply chain. To disrupt that, say move over here, just doesn’t really work.” He went on to say that “… [in China], you got more know-how, more capacity, more engineers, more components on the ground close to your supply base, and you’ve just got more cycles of learning.”

Covid-19

Earlier this year, many of our customers were initially dismayed by the lockdown of Wuhan and the near lockdown of China. But five months on, one of the resounding themes we are hearing from our customers, is praise and admiration for how quickly China was able to deal with the pandemic and to establish process and protocol for moving past the initial wave of infection. As Bill Biancaniello, former division President of Pentair’s Electronics Packaging group, recently stated on another episode of Made-In, “things are going to happen in the supply chain, the real issue is how quickly can your supply chain respond to the disruption and get back on track”. China’s ability to act quickly and decisively has allowed the country to resume pre-virus levels of economic activity relatively quickly. In response to the Covid-19 issue, SCRG China is seeing most of our customers turn to us in a bigger way to take care of their off shore projects in China.

So, what will the post-Covid EMS landscape look like in China, Southeast Asia, and the rest of the world? Although China will likely retain its dominant position as the world’s largest EMS center, some things will certainly change.

Here are my top five predictions for what will likely be different in the EMS industry post Covid-19:

#5: Most of the traditional EMS centers in southeast Asia will see above trend growth from 2021 – 2025 in response to both trade tensions, and real and perceived excess concentration of manufacturing in China by some leading western OEMs.

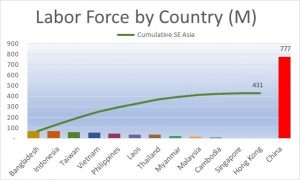

#4: Over the next 5 years, a number of low-cost Asian countries will see new investments in their nascent tech manufacturing industries. This likely includes Laos, Cambodia, Myanmar, and Bangladesh. Much of this investment will be based on the size of existing labor force, as well as growth rates of the labor force and the burgeoning local consumer markets. EMS and ODM companies from Foxconn to Flex realize that these large investments in new manufacturing centers often take 15 years or more before they really become a competitive force at meaningful scale.

Source: World Bank, OECD

#3: Access to China’s EMS factories will become a bit less open to international visitors, as limits are put on the number of visitors, and access controls including health checks and travel questionnaires for visitors become more widely adopted. As the world emerges from the current pandemic, it will become increasingly important for OEMs and Brand Owners to have some form of in-country support for their offshore manufacturing and supply chain activities across all of Asia.

#2: A significant wave of consolidation is likely to occur among China’s smaller EMS companies, which number well over 4,000. For some of these companies, who often survive on the business of just a handful of meaningful customers, the loss of even a single western customer could leave no options other than consolidation or closing. As painful as this may be for the companies involved, this long overdue process will undoubtedly serve to strengthen the overall EMS industry in China as the weakest players get shaken out.

#1: A new breed of mid-sized, China based/China only EMS providers will find their wings and expand outside of China to compete with larger multi-national EMS providers from Taiwan and the US. Companies like Suzhou Dongshan Precision Manufacturing Co. Ltd. And Luxshare Precision Industry Co. Ltd. will likely come to compete with the likes of Benchmark, Plexus, Foxlink and Venture as they export a uniquely Chinese brand of contract manufacturing know how.

As the world continues to struggle with this unprecedented virus, the new normal we will all experience on the other side of the pandemic continues to develop day by day. But when it comes to electronics manufacturing, meaningful changes will take time to implement. The post Covid-19 EMS industry will be a clearly recognizable evolution from its pre-pandemic state, not some revolutionary new and unrecognizable industry.

Derrick Zhao is SCRG’s China Managing Director, based in Shenzhen City, Guangdong.