EV Battery Crunch? No, Some Carmakers Are Just Slow to the Party

By Julian Skidmore, Senior Firmware Engineer, Versinetic

There have been recent concerns raised over a possible EV Battery Crunch, similar to the global chip shortage that disrupted the production of many electronic devices in recent years.

Julian Skidmore

Although the market is seeing some contraction in battery metal supply1, there are two main reasons I don’t equate that with the components crunch.

One: what we’re looking at in terms of the market are actually pretty standard supply and demand curves.

Around half the world is getting into the early majority for EV adoption. China is clearly the global leader for EV adoption for many reasons – their severe air pollution problems, for instance, that they’re looking to address.

Despite issues with coal pollution, China also tops the league table for renewable energy adoption.

Then, there’s Europe, which is definitely reaching the early majority phase. Among the countries leading EV adoption:

- Norway, which is pretty much saturated in terms of new EVs

- Sweden, which is catching up with Norway

- And the other big three – Germany, the UK and France

The UK and France are pretty much head-to-head in terms of EV adoption – 24% for the UK2 in the most recent statistics for plugins, two-thirds of which are pure BEVs (Battery Electric Vehicles).

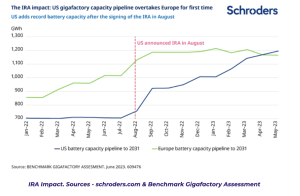

Meanwhile, in the United States, the Inflation Reduction Act is helping to transform electric vehicle and renewable energy adoption across the US; noticeably ramping up quickly in a number of states, such as California.

IRA Impact. Sources – schroders.com & Benchmark Gigafactory Assessment

EV sales leapt 54% during Q1 this year compared to the same period in 20223.

Consequently, we are finally seeing an uptick in adoption in some developing countries that is starting to gain pace4-8.

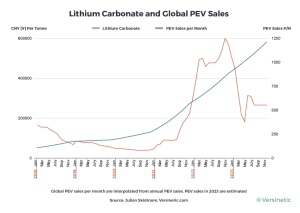

These significant changes in EV adoption rates are consequently causing supply and demand curves.

Now, what you get from supply and demand curves is that when demand rises sharply, there are constraints on the supply of other materials. That is exactly what should be expected. What we’re seeing – and this is borne out by the fact that the costs for electric cars have come down over 2023 means that, as a whole, the supply is keeping pace with demand.

In particular, lithium prices are actually lower by about 50% compared with what they were about a year ago.

The other key point to note is that legacy auto manufacturers were warned about this years ago9-10. And they now seem to be struggling to catch up.

As they’re not currently in the high production phase for electric vehicles, they’re still relatively early in the process of transformation. Some of them just aren’t going to make it likely. Then, they’re finding it difficult to procure supplies for electric vehicle adoption. They may be first here in terms of auto manufacturing, globally, in relation to combustion cars; but in terms of EVs, the majority of the supplies and resources come from people like CATL, Panasonic, and other electric vehicle battery makers.

The companies that are making the new lithium LFP batteries, which use iron, are all going to go to the biggest EV players at the moment – including Tesla, BYD, and XPENG (Chinese EV giants), Volkswagen, Nissan, Renault, Polestar, and Volvo. They are going to get the lion’s share of the resources because these companies have demonstrated a strong commitment to adopting electric vehicle technology.

Although it’s in the European Big Five, Germany has seen pushback from some of its auto manufacturers. They managed to persuade their government to successfully lobby the EU to delay the full switch away from combustion engines until 2035 rather than 203011.

You might expect a degree of contention between legacy technology and new, disruptive technology. This is likely to play out over the next decade, with some renegotiation between the German automakers and the Bundestag. Mostly, what will drive this, however, is renewable energy adoption.

Nevertheless, I think it’s certainly the case that EV charging is probably the next frontier for the early majority.

What we’re looking at is a multi-pronged approach to resolving accessibility, from the easiest to the hardest. For example, 68% of households in the UK have a driveway, and they’re generally wealthier: this gives over 68% coverage, since these people are more likely to have more than one car12. They’ll be the ones who, once they start saving money on their first electric car, will go on to buy a second EV. These households will do the heavy lifting for EV adoption over the next several years.

In the meantime, we urgently need to continue improving the reliability of charging systems in the UK. There are multiple options we can leverage to help people who don’t have street parking.

For instance:

- Domestic parking could potentially also function as public charging.

- Some cases can be met by using cable channels cut into pavements or, failing that, installing EV cable mats. These enable EV users to charge directly outside their house over a distance of up to 10m.

- In addition, charging posts can be embedded into kerb posts or stones, and subterranean solutions where chargers rise out of the ground. These chargers are specially designed for better ingress protection.

- We can also leverage charging points in lampposts13.

- Flats with communal parking facilities are prime targets for private, shared charging points, whether underground or outside at ground-level, since they’ll raise the value of the apartment block.

This leaves about 8% of combustion car-owners without potential access to Electric Vehicles14-15.

Summary

From another perspective, there is no EV battery crunch; rather, what you’d expect in a healthy market – supply constraints due to rapidly increasing demand.

What is also apparent is that legacy automakers are struggling to switch over despite all the clear indications, from combustion engine design teams being disbanded16-17 to the mainstreaming of EV advertising with the near exclusion of fossil fuel vehicles.

Because they know that’s the future.

About the author:

Julian is working on EV charging and V2G projects, and has co-authored EV-related articles for the electronics industry press. He has a Computer Science degree from UEA and an MPhil in Computer Architecture from Manchester University as well as over 20 years’ experience in embedded development.Julian is a proponent of the zero-carbon society and a Guardian News ‘climate hero’. He owns a Battery EV; has investments in wind farm cooperatives and has a 4KW domestic Solar PV installation.

Further reading

1 https://think.ing.com/articles/tightening-supply-shakes-up-battery-metals/

2 https://www.smmt.co.uk/2023/08/summer-surge-as-one-new-ev-registered-every-60-seconds/

8 https://blume.vc/commentaries/ev-adoption-in-india-is-happening-at-a-faster-pace-than-you-think

9 https://www.treehugger.com/can-legacy-automakers-survive-switch-electric-4851471

10 https://edition.cnn.com/interactive/2019/08/business/electric-cars-audi-volkswagen-tesla/

12 https://www.racfoundation.org/media-centre/cars-parked-23-hours-a-day

14 https://www.racfoundation.org/motoring-faqs/mobility

16 https://www.sopheon.com/blog/the-end-of-engine-design

17 https://www.autoweek.com/news/a36292118/phasing-out-internal-combustion-engines/