EMSNOW Executive Interview: Stefan Hasper and Thomas Müsch, Stemas AG

Stemas AG, is a holding company that owns six separate EMS companies in Germany (Elprog GmbH, Frank Electronik GmbH, Eker Systemtechnik-Electronic GmbH, EPS electronic Products & Systems GmbH, micronex GmbH, and PressFinish Electronics GmbH). The strategy appears to be to purchase a controlling interest in smaller well-managed EMS companies and then allow the former owners to continue to manage their businesses while benefiting from the larger corporate relationship. We caught up with Stefan Hasper and Thomas Müsch from Stemas AG to understand how this group came to be.

We founded Stemas AG 15 years ago with the aim to purchase controlling interests in small and medium sized industrial companies with an unclear succession or/and economical difficulties. Since then we have been building up a group of 14 companies with a turnover summing up to 150 m€ and almost 1000 employees.

We founded Stemas AG 15 years ago with the aim to purchase controlling interests in small and medium sized industrial companies with an unclear succession or/and economical difficulties. Since then we have been building up a group of 14 companies with a turnover summing up to 150 m€ and almost 1000 employees.

Stemas is an industrial holding company, not a private equity fund. That also means that we usually do not sell companies, we are a longtime partner. Our first company Weiss Elektrotechnik has been part of our portfolio for 15 years now.

We focus on fragmented industries with a high consolidation potential. Currently there are five major industrial branches in our portfolio: mechanical engineering, electrical motors, inductive components, fire protection and EMS, which is our largest branch with six companies that generate 75 m€ of turnover.

We both are the managing directors of Stemas and still the only shareholders, so the group is privately owned by the management, what makes us fast and flexible. Still we maintain a direct line of communication to the management of our companies.

EMSNOW: The challenge would seem to be maintaining the uniqueness and flexibility of the smaller companies while still standardizing and achieving cost advantages as a larger entity. How does this process work at Stemas?

We believe in the entrepreneurial power of small and medium sized enterprises. They are a key pillar of our country’s competitiveness and sustainability as a business location. In Germany, SMEs represent 99% of all companies; more than half of all German employees work for an SME. Nearly half of all global “hidden champions” are a German SME.

When we buy a company, we want to keep the SME-specific strengths, e.g. flexibility, entrepreneurial serendipity, ability to tweak on the fly, cost awareness, solid customer service, and value-driven employee management to name only some characteristics which differentiate them from the large corporations. So usually the companies keep their brand and their culture when we step in. With our involvement we add the support of a strong group in the fields of finance, controlling, sales, benchmarking, procurement and IT by the Stemas-Team. And we encourage our general managers to stay or become minority shareholders of the companies they manage to support their entrepreneurial thinking and behavior.

EMSNOW: These six EMS companies each act independently in the market, but do they focus on different industry sectors, services or technologies, or do they each pursue whatever business they wish?

As every company we acquire has its own history and own (mostly proven) strategy, which usually doesn’t conflict with the market approach of our other companies, we do not noticeably align individual strategies. And there hasn’t been competitive situations in between the companies. Nevertheless each company has its own specialized knowledge and certifications for specific industries as well as individual production capacities to serve different lot sizes. Moreover some clients like the cooperation of several companies of the Stemas-Portfolio where each company contributes a specific field of know-how.

But a regional or strategic extension can be an argument for the next acquisition.

EMSNOW: Your current geographic footprint includes facilities exclusively in Germany. Is your plan to maintain this focus or will you possibly be expanding into other regions as well?

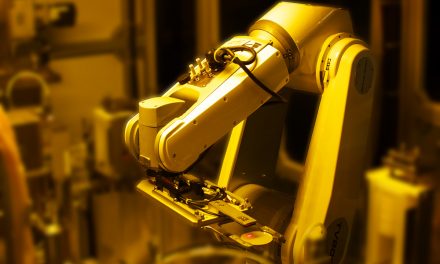

Not only our six EMS companies but all our 14 companies are situated in Germany while we have clients from all over the world. We don’t even have sub-branches abroad; all our almost 1000 employees work in Germany, which is an important argument for many of our customers. Nevertheless that brings the need for constant investments in automation.

We don’t neglect the possibility of a future site abroad but our main focus will remain in Germany.

EMSNOW: The EMS industry is a crowded field of competitors. How do your companies differentiate themselves in this industry? Do they leverage being part of the larger Stemas AG group?

Each of our portfolio companies has its own proven strategy e.g. Frank Elektronik GmbH is a specialist in LED and light-applications. And being part of our EMS-group Elektronik-Gruppe supports the companies to be trusted by all types of clients for their specific abilities.

EMSNOW: Stemas AG also owns other companies, some of which are product companies in the electronics industry. How do these relationships benefit the EMS companies?

Usually the companies act independently in the market, but in some cases they offer joint products or solutions together with their sister companies.

Some of the product companies are clients of the EMS companies (while they are not forced to contract and the conditions need to be competitive).

Companies also benefit from combined fair/exhibition appearances. Last year we attended productronica with 12 companies of four branches in one stall. That was not only an impressive offering for our clients but also a good opportunity to meet and greet among the staff of all our companies.

And last but not least our cross-selling-program enables the sales-staff to approach the clients of their sister companies.

EMSNOW: Where do you see the opportunities for growth in the EMS industry and how are your companies positioned to address these?

As the EMS-market will very likely continue to grow in the next years due to the ongoing trends of outsourcing and digitalization, the segment will stay generally attractive. Our view on growth is additionally driven by the large consolidation potential, so we aim to add more companies to Elektronik-Gruppe as well as to the other branches.

EMSNOW: What issues do you expect to be the most challenging for the EMS industry in the next few years?

Besides the currently faltering economic environment we specifically in Germany notice a growing lack of skilled workers which are necessary for a strong SME sector.

And we are curious about the possible next steps in the digitalization of the production process – within and in between companies along the supply chain.

EMSNOW: Is there anything else you would like to say to the EMSNOW readers?

We are confident that our strategy that we have been following for 15 years now is still up to date as new players have appeared lately who also consolidate the German/European EMS-market. Their strategy still differs from ours as they concentrate on larger companies and they have an exit-focus.

So we look forward to continue and develop our business.