EMSNOW Country Review: Considering Georgia for Electronics Manufacturing

The global pandemic has taught global electronics manufacturing managers that supply chain resilience has real and quantifiable value. The global manufacturing landscape has changed dramatically in the past year. Many companies are re-assessing their electronics manufacturing strategy to reduce risk from long supply chains, geopolitical instability, and other disruptions. Regionalization – the ability to build products close to the end customer – has made its way to the top of the wish list for many OEMs and their EMS partners.

Electronics manufacturing is complex and demanding. Building these products requires stable government, good infrastructure, an educated workforce, regional demand for the products, a good component supply base or access to one and a favorable business climate. When choosing a geography as a site for a new manufacturing facility, all these factors must be assessed. Global electronics manufacturing is a mature enterprise and there are many choices that already are up and running.

EMSNOW has reviewed the latest data pertaining to Georgia’s suitability for electronics manufacturing. This article compiles high tech ‘readiness’ data submitted from the government to help support decision-making.

Why Georgia? Why now?

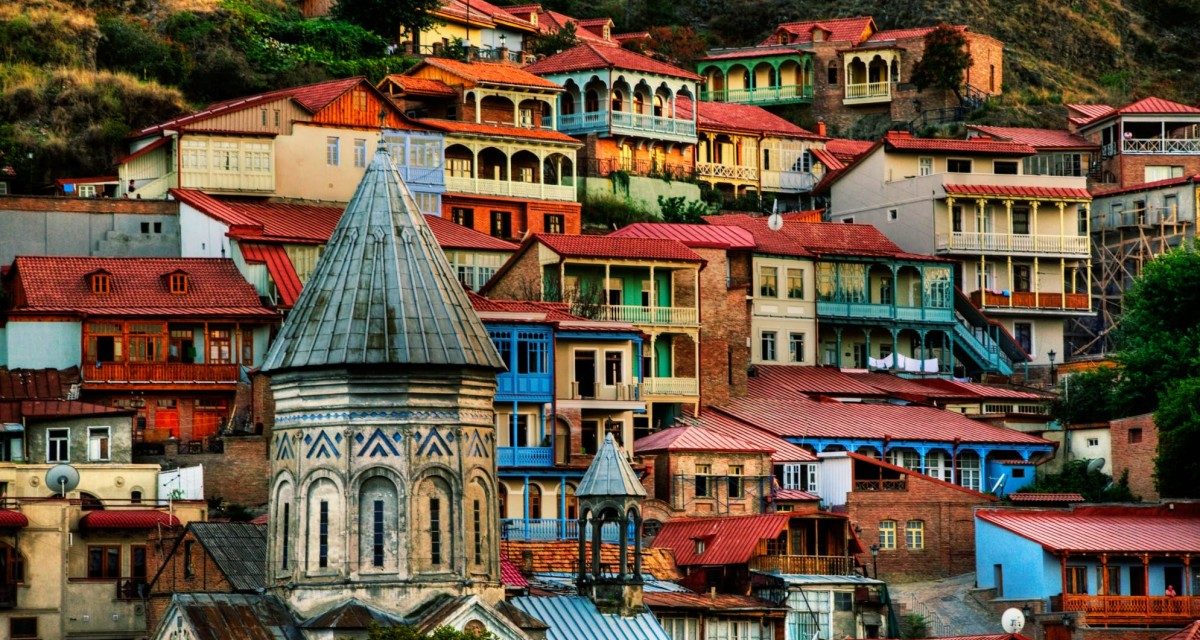

When setting up a regional strategy, location obviously does matter. Georgia is strategically located at the crossroads of Europe and Asia. It has two ports on the Black Sea; three major international airports and controls the land routes through the Caucasus mountains from Russia to Europe. It shares borders with Turkey, Russia, Armenia, and Azerbaijan. The country has a warm climate and an interesting history. Most of the four million people are concentrated in the central valley, particularly in the capital city of Tbilisi in the east; smaller urban areas dot the Black Sea coast, with Batumi being the largest.

The largest shares of GDP by activity are held by wholesale and retail trade; repair of motor vehicles and motorcycles and real estate activities, followed by manufacturing and construction. Hospitality contributes over 20 % of GDP through direct and indirect impacts. Georgia’s mining sector is characterized by several significant deposits and investments in manganese, copper and gold and small-to-medium size quarry operations, primarily marble and construction materials. The country imports natural gas and oil products. Nevertheless, over 75% of electricity is generated from hydro and wind, making electricity not only cheap but also green.

Georgia has three major oil and gas pipelines: (Baku-Tbilisi-Ceyhan (BTC) pipeline, South Caucasus gas Pipeline (SCP) and Western Route Export Pipeline (WREP) also known as Baku-Supsa pipeline) Black Sea ports and construction of Baku-Tbilisi-Kars railroad, together with its international airports are playing an increasingly important role in linking Europe with Asia and making Georgia a regional hub for trade, transport and global investments.

Aggressive government incentives over the last decade have been put in place to encourage foreign direct investment in Georgia. These have borne fruit. Invest in Georgia is the state agency providing a number of incentives and co-investment opportunities to investors interested in developing manufacturing facilities in Georgia. Incentives can include free land and buildings, loan subsidies, collateral guaranteed co-financing and grants. Within the framework of the FDI Grant program, foreign investment projects in advanced manufacturing are able to get cashback of up to 1 million GEL (~300 thsd. USD) for workforce training, infrastructure and/or communications.

Ease of Doing Business

According to the World Bank, Georgia ranked 7th in their 2020 Ease of Doing Business index. According to the OECD FDI Regulatory Restrictiveness Index 2019, Georgia ranks 4th in Eastern Europe and Central Asia Region and 8th globally, making Georgia one of the most open countries for FDI. The tax system is attractive, with a 15% corporate tax rate and 0% on retained and reinvested profit, 18% VAT; 20% personal income tax and a variable import tax of 0%, 5% or 12%, depending on goods imported. Over 80% are taxed at 5%.

Connectivity to Major Markets

Georgia enjoys free trade agreements with the EU, UK, Turkey, China (including Hong-Kong), EFTA countries, CIS countries and Ukraine. This means that by setting up operations in Georgia, companies can benefit from growing regional markets and access to over 2.3 billion potential customers without customs tariffs, making it an potential nearshoring destination

Georgia is connected to the EU’s Trans-European Transport Network and getting in and out of the country is facilitated by a simple and service-oriented customs policy and administration. It is a member of the Middle Corridor and TRACECA system and 80% of goods are free from import tariffs.

The shortest route from Europe to China and Asia passes through Georgia. The traditional sea route takes up to 45 days while a route through Georgia takes only 8-10 days. Customs clearance can be done in as little as 15 minutes in Georgia’s modern Customs Clearance Zones. There is an option to make declaration remotely, in advance.

Electronics manufacturing in Georgia is just beginning but is on a growth trajectory. The demand for electronics is also growing in Georgia and neighboring countries.

Operational costs are competitive, with electricity (per kWh); industrial gas and water at the lowest cost of neighboring countries.

Workforce

Georgia has a well-educated, multi-lingual and young workforce. The total workforce is currently 1.5 million and the literacy rate is 98%; 92% of the population has completed secondary school, with over 40,000 tech graduates from the two major higher education institutes over the past five years.

Major new and upcoming education centers are up and running, including the Kutaisi International University and Georgian Technical Training Center. The latter offers high voltage electrician; mechatronics; industrial automation; and mechanical engineering technician programs.

Kutaisi International University at full capacity will host 60 thousand students. KIU operational model was developed in partnership with the Technical University of Munich and will offer vocational, undergraduate, graduate, and post-graduate degree programs as well as research possibilities in science and technology. KIU will join other high-profile universities such as Tbilisi State University, Tbilisi Technical University, and Ilia State University that in collaboration with San Diego State University offer ABET, ASC, WASC accredited courses in STEM fields.

Georgia has one of the lowest average monthly salary for skilled production workers among low labor cost countries, according to FDI Benchmark from the Financial Times 2021.

Companies Currently Up and Running in Georgia

The electronics and electronic components industry is nascent in Georgia, but the country has attracted several major technologically-advanced investments including Groupe Atlantic and Aionrise (formerly AE Solar). Information about Groupe Atlantic and Aionrise (formerly AE Solar) can be found on the this link.

There are also Georgian companies that are operating in the sector, and a developing competitive supply chain.

The new government in Georgia has a proven commitment to supporting global manufacturing in Georgia and has compiled a wealth of resources for those considering building manufacturing facilities in this well positioned region. Here’s a particularly useful document on manufacturing in general. EMSNOW would encourage those interested to use the website’s excellent resources page to get started. Let us know how it goes.