EMSNOW Analyst Interview: Randall Sherman, New Venture Research

Randall Sherman is President and CEO of New Venture Research, publisher of the MMI Top 50 EMS, and several other important industry reports. We caught up with him to learn more about the latest report on the EMS industry. Here is Part One of an insightful conversation we had with him about his view of the current state of the EMS industry and its growth drivers for the future.

EMSNOW: Congratulations on the recent release of the 2019 edition of The Worldwide Electronics Manufacturing Services Market Report. How many years has it been now since you started covering this industry?

EMSNOW: What is the timeframe and process for producing a large industry research report like this?

We start background research in mid-March getting ready for the 10-K’s, 20-F’s, and 10-Q’s that become available to the public. We then engage in profiling all the private and public companies and their performance from the previous year. That step alone yields some 300+ pages of information and sets the stage for measuring industry growth in 2018. In fact, we have a pretty good idea of industry growth from our MMI (Manufacturing Market Insider) Top 50 survey that gets published in March, but obviously there are a lot more leading EMS and ODM companies that fall outside of the Top 50. This year we covered 102 EMS/ODM companies, which accounts for approximately 80% of the world population. Market segment information is gathered from our surveys; that is an activity we have been doing for years, so we are able to predict what product segments are growing the fastest and what is happening regionally, taking into account the changing manufacturing footprint that restructures from year to year. In summary, we invest hundreds of hours of labor into our annual EMS report. If people want a detailed snapshot of what’s going on in this industry, this is the most comprehensive report available.

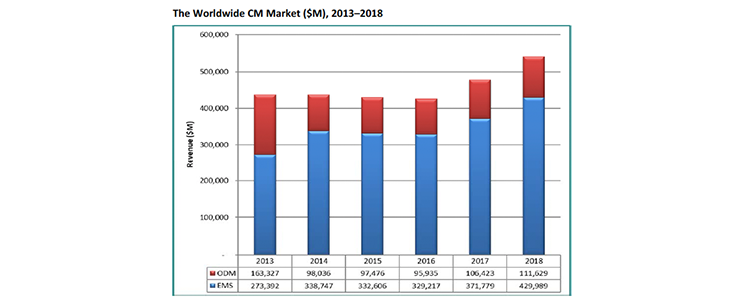

EMSNOW: You use the various acronyms CM (contract manufacturing), EMS (electronics manufacturing services) and ODM (original design manufacturers) to refer to this sector. How do you differentiate among these?

Yes, these acronyms are necessary to separate out the true EMS market. In the case of EMS companies, the acronyms are clear, but in the case of ODM companies, we like to separate out the ODM’s branded product from their EMS services. For example, Quanta Computer has an EMS business which accounts for an estimated 50% of their total production. Quanta Computer is making desktop and notebook computers for Acer, Apple, Dell and HP under their own brand while the other 50% of their production is spent improving their own Quanta Computer branded growth that benefits from their EMS production. These product percentages change every year and Quanta Computer is not that helpful in reporting its outsourced production versus its internal branded production. So, we have to estimate, but it’s better than not estimating at all. Our goal is to establish how much EMS production takes place each year, and this is sometimes called the “pure” EMS market, one that is not compromised by ODM companies like Compal Electronics, Delta Electronics, Qisda, Quanta Computer and others that are filling excess manufacturing capacity and extending their brand and IP.

EMSNOW: There used to be a clear distinction between EMS and ODM, but have these now effectively merged in your opinion?

Yes, I agree. There used to be pretty obvious rules of engagement; for example, ODMs establishing firewalls between value-add design and intellectual property on behalf of the OEM. But lately the big OEMs (Acer, Dell, HP, etc.) are less concerned with protecting their intellectual property as this is contained within the IC and specific modules, and less so on the PCB (which is being populated by the subcontractor). This technology trend is being driven by the need to achieve the lowest total cost of ownership and the commonization of so many new, IC-centered products. If you look at the very latest wearable products, there is very little value-add being provided from the EMS firm other than assembly.