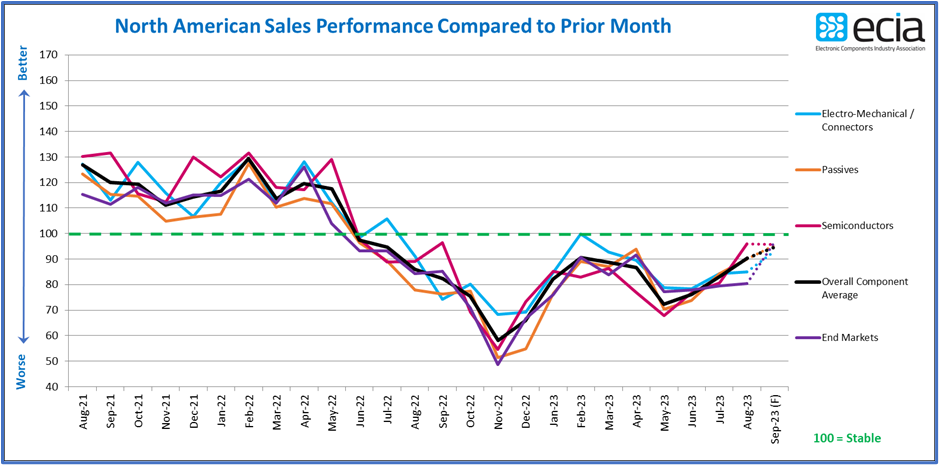

Electronic Components Sales Sentiment for August 2023 Sustains Improving Trend; Q4 Outlook Sets Stage for Q1 2024 Growth

|

ECIA’s Electronic Component Sales Trend (ECST) August & Q3 2023 Survey Results

Atlanta — The August sales sentiment for overall electronic component markets improved by 7.3 points over July to reach 90.3. This continues a trend of improving results that began in June. The outlook for September calls for the index to maintain this upward trend reaching 94.9. “Even though these scores are below the threshold of 100 that divides growing from declining sales sentiment, they are the best scores since February 2023 and an increase of 22.5 points from May 2023” explained ECIA Chief Analyst Dale Ford, author of the report. “Hopefully, if the industry can sustain recent improvements, it is possible that sales sentiment for all categories could top 100 sometime in Q4 which would signal the potential for return to broad-based growth at the beginning of 2024.” |

|

|

The ECST survey provides highly valuable and detailed visibility on industry expectations in the near-term through the monthly and quarterly surveys. This “immediate” perspective is helpful to participants up and down the electronics components supply chain. In the long-term, ECIA shares in the optimism for the future as the continued introduction and market adoption of exciting innovative technologies should motivate both corporate and consumer demand for next-generation products over the long term. View the summary report. The complete ECIA Electronic Component Sales Trends (ECST) Report is delivered to all ECIA members as well as others who participate in the survey. All participants in the electronics component supply chain are invited and encouraged to participate in the report so they can see the highly valuable insights provided by the ECST report. The return on a small investment of time is enormous! The monthly and quarterly ECST reports present data in detailed tables and figures with multiple perspectives and covering current sales expectations, sales outlook, product cancellations, product decommits and product lead times. The data is presented at a detailed level for six major electronic component categories, six semiconductor subcategories and eight end markets. Also, survey results are segmented by aggregated responses from manufacturers, distributors, and manufacturer representatives. For the complete Industry Sentiment August 2023 Outlook Article, members can log in to view here. |