Electrified Vehicles: The Race to Mass Adoption

The coronavirus may have slowed down a lot of industries but the race for widespread adoption of electrified vehicles—such as the plug-in-hybrid vehicle (PHEV), hybrid electric vehicle (HEV), and electric vehicle (EV)—remains underway. Even as the pandemic has brought the world to a standstill, leading automakers remain committed to their vehicle electrification plans. In fact, the automotive industry is charging forward to introduce approximately 600 electrified vehicles through 2025, according to McKinsey & Company.

The coronavirus may have slowed down a lot of industries but the race for widespread adoption of electrified vehicles—such as the plug-in-hybrid vehicle (PHEV), hybrid electric vehicle (HEV), and electric vehicle (EV)—remains underway. Even as the pandemic has brought the world to a standstill, leading automakers remain committed to their vehicle electrification plans. In fact, the automotive industry is charging forward to introduce approximately 600 electrified vehicles through 2025, according to McKinsey & Company.

Originally posted on Jabil Blog

Pandemic or not, the widespread adoption of electrified vehicles relies on unprecedented collaboration within an ever-evolving industry structure, as well an ongoing shift in consumer perceptions.

The reality is that nearly six out of 10 automotive manufacturing decision-makers believe that the mass adoption of fully electric vehicles will not happen until after 2030, according to Jabil’s Managing Automotive Technology Trends survey, which was conducted a year before the pandemic.

While the post-pandemic rollout of electrified vehicles will differ in size and scope worldwide, the pre-pandemic projections remain true. IHS estimates that 50% of all cars sold by 2026 will have electrified drive trains (MHEV, HEV, PHEV or BEV). Rising to 60% by 2029—a true sea change within a 10-year time span.

Four Market Forces on the Road to Widespread Adoption

Electrification’s move from niche market to mainstream is visibly in-process. The array of market forces driving the adoption of increasingly electrified vehicles has resulted in a tipping point. Among global OEMs and Tier 1s, electrification continues to represent the forward-looking movement of the automotive industry.

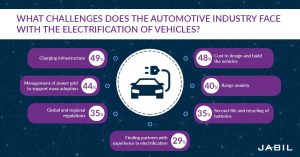

Responses from Jabil’s survey still echo ongoing challenges automakers face nearly every stage of the vehicle electrification process. Top challenges include infrastructure, design and manufacturing, regulations and consumer perceptions.

1. Regulations are Ushering in a New Age of Clean-Energy Transport

Climate change, fuel consumption efficiency and CO2 emissions are ongoing concerns for the general population, and regulatory policies worldwide drive the mandate for more eco-friendly, increasingly electrified vehicles as a result. OEMs are making substantial investments into vehicle electrification efforts.

However, demand for electric cars is unlikely to see the same growth rate across global regions due to differences in regulations and incentives.

A snapshot of Europe-based trends shows immediate CO2 regulations remaining strict; a select-city diesel ban; and, the potential for government incentives for buying an electric vehicle. In May 2020, the French government announced Europe’s most generous incentives to buy an electric vehicle, bringing down the price of the battery electric vehicle by nearly 40% in some cases. All in all, the Europe of 2025 may showcase cities filled with EV-powered transportation, solidifying its place as the global leader in clean mobility.

In China, electrified vehicle adoption shows steady increases. According to the Carbon Tracker Initiative, electrified vehicles accounted for 59% of bus sales and 61% of two-wheeler sales in 2019. The Chinese minister of finance subsequently cut subsidies at the beginning of January 2021. The result of this cut should spark market competition.

Despite huge market opportunity and global trends, the U.S. lags behind Europe and China. In mid-January 2021 the United States government agreed to an auto industry request to delay the start of dramatically higher penalties for automakers that fail to meet fuel efficiency requirements. These changes will help OEMs in the short-term, however industry reports show confidence for automakers as a rapid shift toward vehicle electrification is underway.

Consider also that regulations extend to commercial vehicles. Diesel-intensive semis and cars propelled by traditional internal combustion engines still own the highways, but there is change coming in the commercial vehicle space as well. Last year, Amazon announced its goal to have 10,000 custom electric delivery vehicles on the road by 2022 and 100,000 by 2030. The company’s goal is to achieve carbon-neutral status by 2040. Meanwhile, General Motors is set to launch a new business that will make electric delivery vehicles (among other technology and services) to companies like FedEx and UPS. This new business, BrightDrop, is set to deliver 500 electric trucks to FedEx in late 2021.

In response to current government regulations, incentives and consumer demand, automakers have announced plans to launch several hundred electrified vehicles over the next five years. But despite these launch plans, there is no crystal ball revealing which models and powertrains will be the ultimate winners. It can also be expected that there will be some volatility in the volumes as local, national and regional regulations change and incentives come and go – which makes production flexibility a key element to automaker supply chain and manufacturing strategies.

2. Infrastructure and Power Grid: Charged Cooperation

A significant factor in the future success of the electrified vehicle market is having a reliable, scalable, cost-effective charging infrastructure in place. No one wants to take the Great American Road Trip while worrying about an EV charging breakdown on Route 66. The United States faces a pressing challenge regarding this issue. The International Council on Clean Transportation reports that of 100 U.S. locations featuring charging infrastructure, 88 had less than half of the total needed in place, based on their expected electric vehicle growth.

Charging infrastructure remains a challenge, although many inroads have been made throughout the past few years. Governmental and commercial entities continue to work in tandem to find creative answers. From the architect who designs the spaces and earns local government incentives to the government working with utility companies to provide power infrastructure, a problem-solving, symbiotic approach continues. Ten years ago, for example, power capabilities in the midst of a downtown parking lot were not a reality. Today, they increasingly are.

Different structural setups continue to be required to accommodate differing city layouts. While a densely populated place like New York City with high-rise residential buildings may need charging stations in garages and gas stations, a place like Tampa, Florida, where single-family home units are more common, may require individual charging options at each house. There is no single solution that works for every city or country – and there currently exists no streamlined answer to who owns and controls the charging station ecosystem. Consider the rollout of the first Tesla vehicles. Two charging options existed: charge the electric vehicle at home or risk the battery running out. This changed rapidly as Tesla introduced a global charging network to keep people on the road.

Naturally, as electric vehicle ownership increases, energy companies need to determine how the power grid can support enough stations. Progress has been made in this area — today it’s common to see charging stations at office buildings and shopping malls — but many more will be needed to support mass electric vehicle adoption.

In addition to the infrastructure and power grid, charging speed is another consideration. Currently, a typical electric car takes nearly eight hours to charge from empty-to-full using a 7kW charging point. While vehicle owners are unlikely to wait until the battery pack is empty to recharge their cars, technology developments are enabling rapid charging – with Tesla’s new supercharger delivering around 160 miles of range in 25 minutes, for about $11.

3. Easing Supply Chain Challenges with Manufacturing Partners

The increasing launches of electrified vehicles will, of course, have a knock-on effect through the automotive value chain. Accelerating speed-to-market of new enabling technology and ensuring sufficient component supply to support manufacturing are two core areas that are being investigated across the automotive supply base. As it is impractical for a single company to invest in everything required to deliver electric vehicles to the mass market, we expect to see changes in design and manufacturing trends.

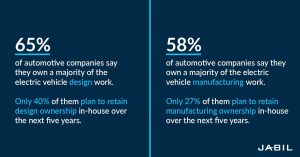

According to the Jabil survey, 65% of the automaker respondents say their organization currently owns a majority of the electrification design work, but only 40% plan to retain design ownership in-house over the next five years. Additionally, 58% say their organization currently owns the manufacturing of electrification technologies, with over a quarter of them looking for opportunities to outsource in the future.

The above data suggests automakers increasingly aim to outsource design and manufacturing operations to strategic partners, allowing automakers to focus resources and financial investments on core competencies. If anything, the COVID-19 pandemic has shown the importance of having a manufacturing partner that can help OEMs successfully mitigate supply chain risk.

In addition, the electronic content of a vehicle continues to expand in scope and sophistication. Today’s standard combustion engine car has up to 3,000 capacitors; however, this number skyrockets to nearly 22,000 multi-layer ceramic capacitors (MLCCs) for a single electric car.

A manufacturing partner will be able to identify multiple reasons why a part may not be ideal, from lifecycle (advance knowledge that it will be out of production soon) to lack of geo-redundancy and subsequently the need to spread out options. Altogether, OEMs need a partner with deep knowledge of the lifecycle of the components needed for automotive electrification and who manages disruptions to the supply chain on their behalf. As electrified vehicle adoption becomes widespread, it will be essential for automakers to partner with suppliers who can build and manage the supply networks required to bring new technology to market.

4. Managing Changing Consumer Perceptions

While consumers will certainly have a choice of electrified vehicle models, the vehicles themselves must first provide a consistent experience at the same level or better than that offered by the internal combustion engine for mass-market adoption to occur. This will happen when consumers feel confident about three factors: cost, and the ability and speed with which to charge the vehicle.

Pre-pandemic data showed that consumers were becoming more receptive to electric vehicles. But attitudes toward electrified vehicles have shifted due to the pandemic. Deloitte’s 2021 Global Automotive Consumer Study reveals that nearly 75% of U.S. consumers are looking for an internal combustion engine (ICE) in their next vehicle, up from 59% in 2020. Anxieties caused by the pandemic have triggered U.S. consumers to revert to familiarity; 84% plan to purchase a traditional vehicle in the future.

Cost is also becoming less of a barrier. The average cost to operate an electric vehicle in the US is $485 per year; to operate a traditional car, a consumer will pay an average of $1,117 according to the University of Michigan’s Transportation Research Institute. Add to that the lack of maintenance costs for electric vehicles, and suddenly a higher vehicle purchase price does not sound limiting. Still, government incentives (as noted earlier) will help bring down the price points and help drive adoption.

The average range of traditional combustion engine vehicles is 418 miles. Meanwhile, the range figures of today’s electric vehicles span 110 miles to 373 miles on average. Although in June 2020, Tesla announced that all North American Model S Long Range Plus vehicles have an official EPA-rated range of 402 miles. And in Jan 2021, China’s Nio announced a range of 600+ miles. These numbers are starting to address concerns around range anxiety. However, Closing the gap between EVs and traditional vehicles will make a big difference in consumer acceptance.

Still, the need for greater charging infrastructure and the speed with which vehicles charge needs to be increased. For mass-market adoption, the charging experience must resemble the gas station model. Evolution in battery technology and charging systems should overcome these concerns.

According to a study by FullyCharged, 88% of consumers who own an electric vehicle would not return to gasoline-powered cars. This means that most consumers who make the transition to electric vehicles have a favorable experience overall. The question then becomes: Are we doing enough to educate consumers about the realities and benefits of owning an electric car? When the industry starts doing a better job of that, the sector should grow exponentially.

Though the pandemic shifted global attention to public health, widespread adoption efforts for electrified cars continue. These vehicles represent undeniable potential to make the world better. No manufacturer or provider can chart the path alone; this race is one that requires collaboration, partnership and plenty of charging stations. The post-pandemic EV future is promising. Some might even say: electric.