ECIA’s Electronic Component Sales Trend (ECST) Survey Projects Continued Sales Growth in November 2020

ECIA’s Electronic Component Sales Trend (ECST) survey that was just completed points to continued, but softer, sales growth for electronic components in November 2020 compared to October. This follows two months of strong sales growth in September and October following a recovery in sales that began in August as measured by the same survey. This is a very hopeful indicator that the electronics and electronics components industry is on a solid rebound after weathering the impacts of the COVID-19 pandemic earlier in the year. However, the expectations are for softer sales growth in November compared to October. In a typical seasonal cycle, sales would usually remain strong through both October and November. However, overall concern about a softening overall economic environment may be influencing expectations for the near term. Economists point to the need for another round of stimulus by the government to keep GDP momentum going. However, action on the stimulus has been delayed by the political uncertainty leading up to the 2020 elections.

ECIA’s Electronic Component Sales Trend (ECST) survey that was just completed points to continued, but softer, sales growth for electronic components in November 2020 compared to October. This follows two months of strong sales growth in September and October following a recovery in sales that began in August as measured by the same survey. This is a very hopeful indicator that the electronics and electronics components industry is on a solid rebound after weathering the impacts of the COVID-19 pandemic earlier in the year. However, the expectations are for softer sales growth in November compared to October. In a typical seasonal cycle, sales would usually remain strong through both October and November. However, overall concern about a softening overall economic environment may be influencing expectations for the near term. Economists point to the need for another round of stimulus by the government to keep GDP momentum going. However, action on the stimulus has been delayed by the political uncertainty leading up to the 2020 elections.

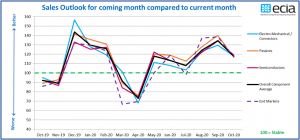

It is interesting to note that expectations for all three major component categories (Electro-Mechanical/Connectors, Passives and Semiconductors) and the end-market are closely aligned in expectations for November sales growth. The index, which captures a top-level summary of the detailed survey results, shows that all major areas register between 116 and 119 for November’s projections. Any measurement above 100 indicates expected growth. Previously, the expectations for sales growth in October as measured by the September survey ranged between 130 and 140 on the index. Measuring the sentiment of actual results, the index of survey responses shows that October’s sales compared to September came in between 125 and 143.

The detailed survey results for end market growth expectations reflect continuing broad-based optimism for improving performance across all sectors. The index of growth expectations for end-markets shows all segments above the threshold of 100 for the third month in a row. (One minor exception is consumer electronics which came in at 96 in the August survey expectations for September.) Even Automotive Electronics and Industrial Electronics which have struggled the most during the past year in addition to Consumer Electronics, have now shown consistent expectations for improved performance recently. There are still many variables that could influence future market sales growth. For example, most economists are still “glass half empty” in their perspective as they look at the most recent GDP results for the U.S. In addition, fears of a resurgence in cases of COVID-19 could also have a significantly negative effect in the winter months. However, at this point reasonably optimistic expectations for near-term growth are being reported by the electronics components supply chain participants.

The monthly ECST survey has proven to be a valuable barometer of current sales and helpful predictor of future sales since it was launched one year ago in October 2019. It is a complementary companion to the ongoing quarterly ECST survey. The survey has received strong and growing support by electronic component manufacturers, manufacturer reps and distributors and ALL ECIA members are encouraged to participate in the surveys.

ECIA members can view detailed results of these monthly surveys in the “North America Electronic Component Sales Trends (ECST) report in the Stats & Insights section. This report presents data in 43 figures and 172 tables covering current sales expectations, sales outlook, product cancellations and product lead times. The data is presented at a detailed level for six major electronic component categories and eight end markets. Also, survey results are segmented by aggregated responses from manufacturers, distributors, and manufacturer representatives.