ECIA Coronavirus Survey – Update 9: Results of Manufacturer & Distributor Survey Ended July 15, 2020

As the Coronavirus / COVID-19 pandemic continues to impact electronics components supply chain participants the most recent data from ECIA’s survey of manufacturers and distributors yields a picture of modest overall improvement and stabilizing results. The results reflect the hopeful economic uncertainty that still exists as many states have pulled back from reopening businesses in the face of renewed growth in COVID-19 cases. Other factors such as societal unrest and competing federal government stimulus plans continue to leave supply chain managers in a challenging position. There is no clear trend one way or the other in the overall economy and that is reflected in the electronics components industry. Revenues in the first half of 2020 were much more solid than originally feared and hopes for the second half remain. However, as always, the ability to manage the pandemic is over-riding all other factors as we look forward. The challenges of the pandemic remain and concerns regarding a “second wave” continue.

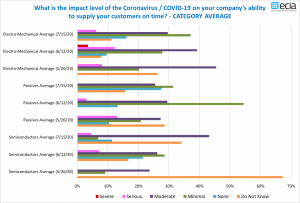

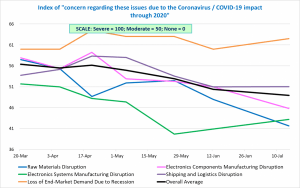

Survey responses across a range of measures show easing concerns regarding the health of the electronics components supply chain. Concerns about end-market demand remain high and there is a modest increase in concern regarding electronics systems production. On the other hand, electronics component production and raw materials supply saw notable decreases in concern. The index for the impact of COVID-19 on the supply of passive and electro-mechanical components continued to trend down in the latest survey while semiconductors saw a reversal to its previous higher level of concern. There is some cognitive dissonance in the survey between the supply chain impact results and the overall trends for increased lead times due to COVID-19. The index for passive and electro-mechanical components measured expectations for increased lead times while semiconductor lead times are expected to decrease.

Expectations for end-market demand and confidence in booking backlogs continue to align generally. The outlook for individual end markets saw automotive electronics continue its rebound from very depressed levels while the high expectations for medical electronics moderated slightly. The telecom infrastructure market outlook continued to brighten while all other segments remained relatively stable from the last survey. The brightest outlooks are still seen in Medical Electronics, Computers & Data Processing and Telecom Infrastructure. The view for Consumer Electronics is more uncertain but still tilts toward expectations of a decline. Defense / Aerospace electronics appear to be the most resistant to impacts from the pandemic.

Confidence in order backlog increased substantially for electro-mechanical components in the latest survey while confidence in passive component orders remained stable. Semiconductors saw a significant decline in order backlog confidence. On the question about the impact of government quarantine orders on a company’s workforce and operations nearly half see a “moderate impact” now. The results saw more consolidation around a moderate impact and a slight increase in “no impact” with nobody reporting a “severe impact.”

ECIA began conducting surveys of member manufacturing and distributor companies at the start of February to provide visibility on the ever-evolving impact of COVID-19 on the electronics components supply chain. This most recent survey was conducted between Wednesday, July 8th and Wednesday, July 15th.

Figure 1 – On Time Supply Impact Average on Top Level Categories

Source: ECIA

Figure 2 – Index of Supply Chain Concerns

Source: ECIA