ECIA Coronavirus Survey – Update 11 Results of Manufacturer & Distributor Survey Ended September 18, 2020

By Dale Ford, ECIA Chief Analyst

Introduction

Positive developments in both economic progress and battling the pandemic have buoyed the manufacturing world, including participants in the electronics components supply chain. The latest results from the ECIA survey on the COVID-19/Coronavirus impact reveal a renewed surge in supply chain health and optimism. Many improving economic indicators continue to lend strength to the manufacturing sector. A recent Wall Street Journal (WSJ) report highlighted a return in global trade that is faster than expected. The WSJ article trumpets, “Global trade is rebounding much more quickly this year than it did after the 2008 financial crisis, lifting parts of the world economy and defying predictions the pandemic could send globalization into permanent retreat.” They share data from IHS Markit that shows 14 of 38 economies reporting growth in new export orders in August compared to just four in June with many others trending in the right direction. In addition, major ports in China are surpassing 2019 shipments with increasing frequency and South Korean exports were only 0.2% below the same period in the prior year for the first 10 days of September. As the electronics industry benefits from global trade, this report is a highly encouraging indicator.

However, there is still cause for concern as many experts express concern about a possible pandemic resurgence as the Northern Hemisphere approaches the winter months. Unfortunately, widely reported errors in data meant to track the pandemic and claims of manipulation of results leave businesses and individuals without reliable information to assess the true status and trend of the pandemic. In addition, economists are warning about a potential stall in economic progress in the fourth quarter of 2020. In a recent ECIA podcast interview for “The Channel Channel”, economist Cliff Waldman, CEO of New World Economics, expressed concern that the failure of the US government to deliver another package of pandemic relief will undermine the strength of the economy. This aligns with concerns expressed by others that without extended financial relief the economy will lose momentum.

To return to the good news, analysis of the latest ECIA survey reveals a supply chain that has returned to its healthiest condition since early 2020. This is true in almost every measure covered in this report. It has been one month since the last ECIA survey focused on the impact of COVID-19 on the electronics components supply chain. While the August survey responses across a range of measures showed a significant jump in concerns regarding the health of the electronics components supply chain, the September survey reports a complete reversal of that surge of concern. Measurements related to on-time delivery, strength of the end-markets and order backlogs, the health of each stage of the supply chain, etc. all show highly positive results. It appears that the concentrated, collective management of the supply chain, building on a wealth of experience in managing previous crises, has enabled the electronics components industry to successfully navigate this uniquely challenging year.

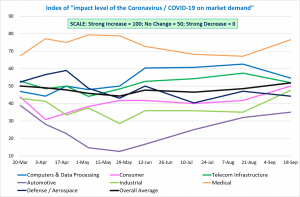

Expectations for end-market demand and confidence in booking backlogs continue to align generally and the reported outlooks are all gravitating to the center – “No Change” in market demand and “Average” in order backlog strength. In measuring expected end-market demand, the overall average for impact on end-markets was 41% for “No Change” and 29% for a “Moderate Increase.” The index of overall end-market demand crossed above 50 (indicating an overall increase in demand) for the first time since the surveys began in February as it hit 51.8. Even Consumer Electronics hit a score of 50 for the first time with Industrial Electronics not far behind as it improved to 47.5. The overall order backlog strength came in at 62% “Average” and 31% “Strong.” The brightest outlooks are still seen in Medical Electronics, Computers & Data Processing and Telecom Infrastructure. The survey results for end-market demand expectations continue to establish a reasonably sturdy platform for electronics component demand as we continue through the second half of 2020.

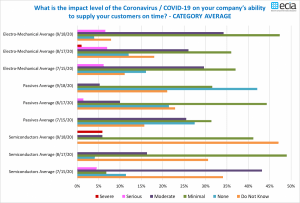

For Electro-Mechanical components, the most common response for impact on ability to deliver on time was “Minimal” at 47%. Even better, Passive components show a peak response at “No Impact” at 42% followed by “Minimal” at 32%. Following its typical pattern throughout this series of surveys, the attempt to measure impact on Semiconductors was difficult as 47% reported “Do Not Know.”

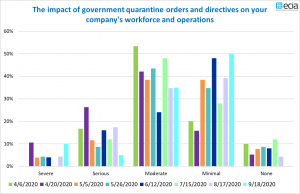

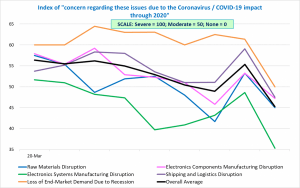

The index of concern for supply chain health dropped to 45.3, indicating only a minimal to moderate level of concern regarding the overall electronics components supply chain. The area of greatest concern is end-market demand but even that measure fell to 50, which represents moderate concern. The area of least concern is “Electronics Systems Manufacturing Disruption.” On the question about the impact of government quarantine orders on a company’s workforce, the shift from “moderate” to “minimal” impact as the most common response continues. The September survey showed 50% reporting only minimal impact from quarantines and 35% seeing a moderate impact.

ECIA began conducting surveys of member manufacturing and distributor companies at the start of February to provide visibility on the ever-evolving impact of COVID-19 on the electronics components supply chain. This most recent survey was conducted between Friday, September 11th and Friday, September 18th.