DRAM Revenue for 1Q21 Undergoes 8.7% Increase QoQ Thanks to Increased Shipment as Well as Higher Prices, Says TrendForce

DRAM Revenue for 1Q21 Undergoes 8.7% Increase QoQ Thanks to Increased Shipment as Well as Higher Prices, Says TrendForce

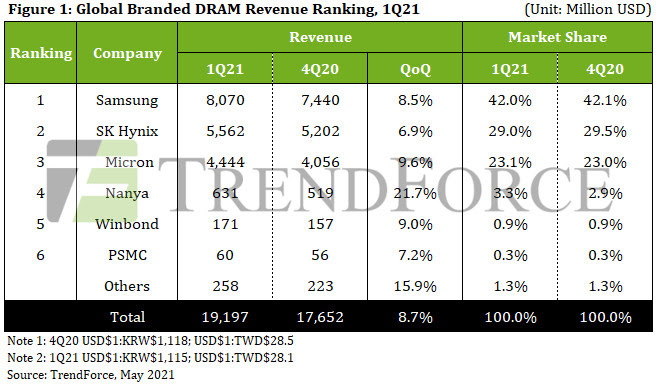

Demand for DRAM exceeded expectations in 1Q21 as the proliferation of WFH and distance education resulted in high demand for notebook computers against market headwinds, according to TrendForce’s latest investigations. Also contributing to the increased DRAM demand was Chinese smartphone brands’ ramp-up of component procurement while these companies, including OPPO, Vivo, and Xiaomi, attempted to seize additional market shares after Huawei’s inclusion on the Entity List. Finally, DRAM demand from server manufacturers also saw a gradual recovery. Taken together, these factors led to higher-than-expected shipments from various DRAM suppliers in 1Q21 despite the frequent shortage of such key components as IC and passive components. On the other hand, DRAM prices also entered an upward trajectory in 1Q21 in accordance with TrendForce’s previous forecasts. In light of the increases in both shipments and quotes, all DRAM suppliers posted revenue growths in 1Q21, and overall DRAM revenue for the quarter reached US$19.2 billion, an 8.7% growth QoQ.

Demand for PC, mobile, graphics, and special DRAM remains healthy in 2Q21. Furthermore, after two to three quarters of inventory reduction during which their DRAM demand was relatively sluggish, some server manufacturers have now kicked off a new round of procurement as they expect a persistent increase in DRAM prices. TrendForce therefore forecasts a significant QoQ increase in DRAM ASP in 2Q21. In conjunction with increased bit shipment, this price hike will likely drive total DRAM revenue for 2Q21 to increase by more than 20% QoQ.

Rebounding DRAM prices were the primary revenue driver for major suppliers in 1Q21

With regards to revenue, the three largest DRAM suppliers saw increases in both ASP and bit shipment. Their better-than-expected shipment performances can mostly be attributed to the fact that an increase in DRAM quotes prompted buyers to ramp up their procurement efforts ahead of time. In particular, Samsung, SK Hynix, and Micron saw QoQ increases of 8.5%, 6.9%, and 9.6%, respectively, in their revenues in 1Q21, although their market shares remained largely unchanged, with only Micron registering a slight gain, at a 23.1% market share. Going forward, the three suppliers’ market shares will unlikely undergo drastic changes in 2Q21.

With regards to profitability, despite the 0-5% increase in DRAM ASP in 1Q21, suppliers registered varying quarterly performances because they each had varying schedules of migrating to advanced process technologies. For instance, Samsung’s 1Znm process had a relatively low yield rate in 1Q21 as the company had only initially kicked off mass production with the 1Znm process. As such, the company’s operating profit margin dropped from 36% in 4Q20 to 34% in 1Q21. On the other hand, SK Hynix benefitted from improvements in the yield rate of its new process technologies and saw a corresponding improvement in its operating profit margin from 26% in 4Q20 to 29% in 1Q21. Finally, Micron’s quotes for the Dec 2020 to Feb 2021 fiscal period increased by a similar margin compared to its Korean competitors, and its operating profit margin for this fiscal period likewise rose to 26%, from 21% in the prior quarter. On the whole, TrendForce expects these suppliers to experience considerable improvements in their profitability in 2Q21 due to surging quotes. In particular, as the yield rate of Samsung’s 1Znm process approaches mature levels, Samsung will likely register the highest growth in operating profit margin among the three suppliers.

DRAM suppliers will accelerate their capacity expansion plans in 2H21 in light of bullish DRAM demand

The three largest DRAM suppliers have been responding to the rising demand for DRAM from various end-product segments by accelerating their capacity expansions and advanced process migrations. However, the newly added production capacities will not have a noticeable effect on the supply and demand of the DRAM market this year because most of these capacities will be installed in 1H22. With regards to the three aforementioned suppliers, Samsung is not only slowing down the transition of its Line 13 from DRAM manufacturing to CIS (CMOS image sensor) manufacturing, but also aiming to expand the production capacity of its Pyeongtaek-based P2L fab by the end of the year, in response to the bullish uptrend in specialty DRAM demand.

SK Hynix is both slowing down the transition of its M10 fab from DRAM manufacturing to logic IC manufacturing and reallocating some of its 2022 capital expenditure to 2021. Although there will likely be a slight increase in the wafer input for DRAM at SK Hynix’s new M16 fab at the end of 2021, the growth in SK Hynix’s supply bits this year will be mostly derived from the increased share of DRAM manufactured with the 1Ynm and 1Znm processes. Last but not least, Micron is continuing to focus on 1Znm and 1αnm mass production, in addition to raising the share of DRAM manufactured with these processes in its total DRAM bit output this year. Owing to its cost advantage, the 1Znm process has become the primary focus of Micron’s process developments. This process is also being widely used for various DRAM products manufactured by the company. Furthermore, Micron is making a fast push for next-gen process migration by submitting its next-gen 1αnm DRAM products for verification. Regardless, the company’s DRAM wafer input this year is expected to remain unchanged from last year, since Micron will not expand its total production capacity by constructing additional fabs in 2021.

Taiwanese suppliers are dynamically adjusting their production capacities ahead of price hikes in the bullish specialty DRAM market

Compared with the three major suppliers, Taiwanese suppliers have been posting even better performances, primarily because specialty DRAM underwent the first and most significant price hike among all DRAM product categories. More specifically, Nanya Tech benefitted the most from the surge in specialty DRAM quotes and experienced a QoQ growth of 21.7% in its revenue for 1Q21, with a corresponding surge in its operating profit margins from 8.8% in 4Q20 to 17.1% in 1Q21. Winbond had a relatively healthy level of client orders throughout 1Q21, during which its specialty DRAM and NAND Flash businesses demonstrated the most remarkable performances. Given that the specialty DRAM segment was the first to recover among all DRAM categories, Winbond’s DRAM revenue increased by 9% QoQ in 1Q21. Even so, TrendForce believes that Winbond will not make noticeable contributions towards alleviating the current shortage of specialty DRAM until its Luzhu-based fab in Kaohsiung kicks off mass production in 2022. PSMC’s revenue for 1Q21, which includes only revenue from its in-house PC DRAM products and excludes revenue from its DRAM foundry services, underwent an approximately 7% growth QoQ, though this figure is about 16% if the latter were also included.

In response to the current DRAM shortage, the three Taiwanese suppliers have been quick to maximize their production efficiencies by migrating some of their production capacities to products in which they have a competitive advantage. For instance, Nanya Tech has migrated some of their 20nm production capacity from DDR4 DRAM to DDR3 DRAM since the latter is currently more profitable than the former. Conversely, Winbond is allocating its limited DRAM production capacities primarily to low-density products (which are among the most niche products) since doing so gives Winbond substantial power to dictate prices in this product segment. PSMC is profiting from the high demand for logic IC and specialty DRAM by prioritizing its capacity allocation between the two products based on their respective quote levels.