Dieter Weiss’ Final Data for EMS production 2017 in Europe

By Dieter Weiss, in4ma

Deiter Weiss

This is no typing error; we are talking about 2017 numbers, even though we just started 2019. If one analyses actual numbers rather than making assumptions, one cannot publish numbers, until the big EMS production companies have published their numbers in the company registers. In this case, it was the biggest global and European EMS manufacturer, Foxconn, whose European numbers were not published in the Czech company register until last week. Just taking the global numbers and assuming they are spread among the different continents equally is a fatal error and not the way, the in4ma statistics are generated.

This is the reason, why today you only see the final numbers for 2017. Preliminary numbers for 2018 will only be available mid of 2019, before the final numbers for 2018 will probably be issued in January 2020.

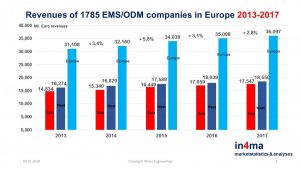

Different to previous years, there will be no additions to the numbers for non-detected smaller EMS companies. The total count of EMS companies now stands at 1785 legal entities, which belong to about 1500 companies and represents about 99% of all EMS companies in Europe.

These companies had revenues of about 36.1 Billion Euros (40.78 Billion USD) in 2017, which includes the Russian EMS market as well.

The Eastern European EMS companies are growing faster than the West, but the West still holds 51.4% of all European production.

The structure of the European EMS manufacturers is dominated by the three big global EMS: Foxconn, Flex and Jabil. Their share of the European production dropped from 32.4% in 2016 to 30.5% in 2017. The TOP 10 in Europe, which have nearly 70 different factories/legal entities, have 40% of all European revenues and the TOP 50 hold 60%.

Calculating the growth rate of the EMS companies in Europe without the big three, one gets to a growth of 3.4% for 2016 and a growth of 5.6% for 2017. The big three actually lost 0.5% of revenues in Europe in 2017.

The analysis for 2018 starts next week with the annual survey of the European EMS companies.