Decline in Quarterly Server Shipment Projected to Widen to 4.9% QoQ in 3Q20 as Enterprises Defer Server Procurement Plans, Says TrendForce

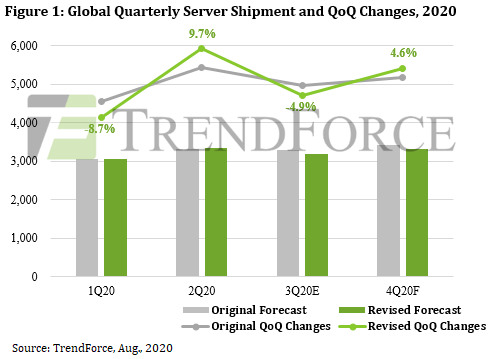

Many enterprises transitioned their CAPEX in server procurement to OPEX in managed cloud services in 1H20 in the face of economic and other uncertainties from the COVID-19 pandemic, according to TrendForce’s latest investigations. These enterprises have subsequently slowed down their server procurement orders, in turn resulting in enterprise server suppliers, led by Dell and HPE, to revise down their yearly shipment targets starting in 3Q20. TrendForce has thereby also revised the forecasted 0.8% QoQ decline in 3Q20 server shipment down to 4.9%.

Server OEMs are actively adjusting their operating strategies in response to looming trend of enterprise cloud adoption

TrendForce indicates that the shipment performances of the enterprise server OEMs made an expected rebound in 2Q20 after the cyclical downturn of 1Q20. Although third quarters are traditionally peak seasons, the pandemic has induced enterprises to lower their CAPEX this year, with a noticeable lack of growth momentum in the server market, thus resulting in QoQ declines in server shipments across the board in 3Q20. Major server OEMs, including Dell, HPE, Huawei, and Inspur, are expected to each show a near-double digit QoQ decrease in server shipment.

In terms of the individual server OEMs’ strategies this year, Dell’s transfer of high-grossing production lines to Taiwan and aggressive expansion of cloud service clientele (such as financial institutions and small-scale CSPs) are projected to maintain Dell’s competitive advantage as enterprises transition into cloud solutions. Its subsidiary EMC meanwhile remains the best-of-breed solutions provider in the enterprise cloud storage market. But the general trend for enterprises worldwide to lower their CAPEX in response to the pandemic is projected to impact Dell’s shipment performance in 2H20.

HPE shifted nearly 10% of its server offerings to AMD’s Rome platform in 1H20, but it encountered certain challenges during the early stages of this transition because most of its clients were still on Intel’s platform. HPE therefore performed below expectations in the first two quarters of the year. Furthermore, as the company’s production lines were affected by the pandemic in 1H20, the ensuing labor shortage at assembly plants meant many server barebones could not be assembled into full systems. HPE is therefore likely to register a QoQ decline in server shipment in 3Q20 due to excess inventory of server barebones and lowered volume of orders from existing enterprise clients.

Thanks to increasing orders for data center assembly from North American clients, Lenovo’s performance in 3Q20 appears remarkable, as the company’s production lines were immediately taken up by server assembly orders from Microsoft. Lenovo is the only manufacturer among the top five server OEMs to record a growth in server shipment in 3Q20 against the overall downtrend.

Stagnant penetration rate of Chinese-made servers is linked with the status of new infrastructure development in China

With regards to the Chinese market, the fact that most hyperscale data centers and CSPs based in China opt for servers made by Chinese manufacturers drove up server shipments from Inspur and Huawei. However, under the influence of the economic downturn in 3Q20, infrastructure build-out in China has not taken place on schedule, leading to lower than expected levels of server procurement by enterprise clients compared to forecasts made in early 2020. As such, Inspur and Huawei are likely to face imminent declines in server shipment as well.