China’s Three-Way Recipe for Semiconductor Autonomy and Global Industry Impact

With the rise of technology sovereignty, major economic regions are aggressively developing self-sufficient ICT industry supply chains with the semiconductor industry as a key focus area. To contain China’s development in semiconductors and technology, in addition to export control and enactment of the CHIPS Act, the United States has also joined forces with the Netherlands, Japan, etc. to restrict China’s acquisition of semiconductor equipment tools (e.g., EUV and DUV), materials, specialty chemicals, software (EDA and IP) capabilities.

Despite this restrictive environment, Chinese vendors continue to adapt, and IDC has observed these key trends that deserve special attention:

- Mature Manufacturing Processes Development and Government Subsidy Policy Models Transformation

As China is unable to develop its advanced manufacturing processes because of export controls on equipment, mature processes have become its industrial development focus. In the past, to develop semiconductor autonomy, Chinese government subsidies were mostly on the expansion of wafer manufacturing capacity. However, due to the overall environmental impact and the inability to obtain more substantial orders, many plants have become idle, underutilized, and unable to produce sustainable benefits for industrial development. To remedy this, the current government subsidy model was changed. Now based on operating results, wafer factories must obtain orders first and have a certain degree of capacity utilization to obtain government subsidies. This shift has made Chinese wafer fabs more active in attracting customers through different strategies (e.g., low pricing, placing orders first and then returning part of the investment amount later, etc.). Compared with the previous subsidy model, this incentivizes local fabs and IC design companies to expand their business.

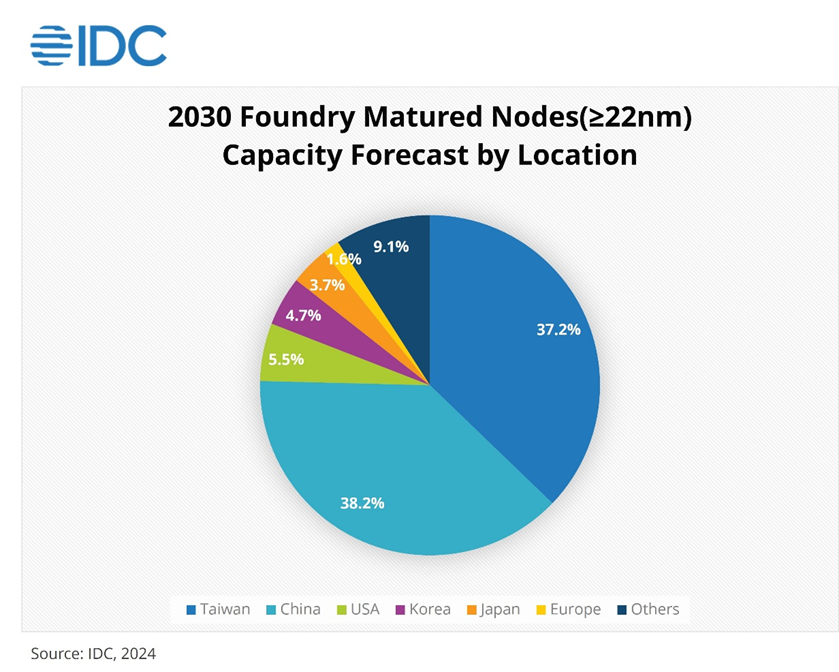

China’s wafer fabs are currently self-sufficient in 22/28nm and older process technologies (given the available equipment tools). In the future, through government policies and subsidies, coupled with the support of China’s huge domestic demand market, it is expected that China will have a mature process market in 2030 (≥ 22nm) and will reach nearly 40% share (30% in 2023). China’s influence on the global semiconductor production capacity will also increase as it puts pressure on International Device Manufacturers (IDMs) and foundries focusing on mature nodes.

- Focus on Wide-Bandgap Semiconductors

Wide-bandgap semiconductors, such as silicon carbide and gallium nitride, have the characteristics of low power leakage, high power, high-temperature resistance, and high voltage resistance. They are especially suitable for high-voltage and high-current environments. Therefore, in the future, wide-bandgap semiconductors will play a key role in applications such as electric vehicles, high-frequency communications, 5G communications, and green energy. At present, Wide-bandgap semiconductors are mostly regarded as national security-level industries. These are also the projects regions are investing in, developing, protecting, and establishing policies to encourage investment and export controls.

Every region expects to maintain technological independence in wide-bandgap semiconductors. China has listed it as a development priority in its 14th Five-Year Plan and hopes to further develop the technology and use it rapidly in new energy vehicles, communication industries, etc. Under this initiative, related applications are the focus. In 2023, China’s capacity of silicon carbide (SiC) crystal growth continued to grow. In addition to joining hands with IDMs, China will also begin to enter the power components market. If the new production capacity is effectively produced in 2024, China SiC wafer’s market share will increase significantly, and its industrial influence cannot be ignored.

- Actively Lay Out Chiplets

China is also using chiplets to connect chips with different functions and slow down the impact of the restricted development of high-end chips. China has established a chiplet alliance and produced their first chiplet technical standard. In the “Advanced Cost-driven Chiplet Interface(ACC 1.0)” drafted by China ChipLet League in 2023, more emphasis was also placed on optimizing China’s packaging and substrate supply chain through chiplets and expanding related packaging technologies. However, although China actively hopes to break through in this area, not all chips are suitable for chiplets. For example, chips used in consumer electronics, such as mobile phones and laptops, rarely require chiplet designs. In addition, chiplet design requires more IP and usually the use of advanced packaging technology which is costly and not China’s strength. It will take time to see whether chiplets can become a key driver of China’s semiconductor independence in the future.

Bigger Challenges Lie Ahead

In their efforts to further the development of their semiconductor industry, China has seen initial positive results in the mature processes and IC design fields. However, from a long-term development perspective, semiconductor equipment is still an important key. The market for semiconductor equipment and related components and materials is quite fragmented, and the certification process is complex and cyclical. This market is also currently highly concentrated in the United States, Netherlands, and Japan. Hence, it will remain a challenge for China to achieve full autonomy.

Currently, under the ban, China is no longer able to import high-end machines from ASML. How long the existing tools in the facilities supplied by ASML can maintain operation still needs to be evaluated. Although China actively supports local equipment manufacturers, and related manufacturers, such as Northern Huachuang, AMEC, and Shanghai Microelectronics (who are actively expanding their business), these manufacturers still lag by more than 5 generations compared to international first-tier tool manufacturers in terms of product accuracy and performance. Also, although China has invested in dry/wet etching, thin film deposition, and polishing and grinding equipment, there is still a gap in lithography tools. In the latest phase (the third phase) of China’s National Fund’s plan, related news mentioned that one of China’s areas of focus and development is in chip manufacturing equipment, highlighting the important correlation between semiconductor equipment and China’s semiconductor industry development.

China has actively maneuvered through the ban on semiconductor policies in the United States and other countries and has quickly adjusted its policies. However, as semiconductor equipment and related components are still heavily dependent on imports, it will not be easy to achieve full autonomy within five years. Relying on external advanced technology and equipment, we expect China’s semiconductor development will be a gradual process even with the strategy of upgrading technology and gradually increasing manufacturing experience.

On the other hand, China has gained the opportunity and motivation to develop mature processes despite the restrictions comprehensively. Their mature processes can still meet the requirements of current applications, including consumer electronics, automotive electronics, and industrial, among many other applications in the semiconductor market. Despite all these, China is still currently the second-largest semiconductor application market in the world. As their share of mature processes gradually expands in the future and related IC design capabilities gradually improve, China will still play a key role in the development of the global semiconductor industry.