No More Fake News in European EMS Market Sizing

By Dieter Weiss, in4ma

The era of fake news about the European EMS market is over!

E³MS, a project of analysis of the European electronics engineering (E³) & manufacturing services industry is finished. Three years of research, lots of night shifts at the computer, incredible amounts of chargeable downloads from European company registers, many translations of annual reports of European EMS in several different languages, crosschecks of more than 1700 internet pages of EMS companies, all resulted in the in4ma database about the European EMS Industry.

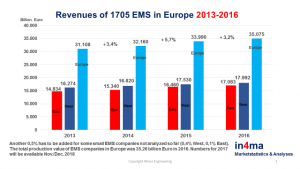

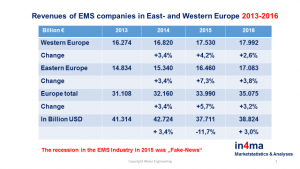

Today, there are 1705 different EMS legal entities in Europe, belonging to about 1400 different companies. They achieved revenues of 35.075 Billion Euros in 2016. Yes, you read correctly, 2016. Anyone who told you numbers about 2017 in the beginning of 2018, told you fake news. Even now, in the middle of the third quarter of 2018 it is not possible to give you correct numbers for 2017, not even close.

The three biggest European EMS, Foxconn, Flex and Jabil have not reported all of their results in the country company registers so far. If you read European EMS numbers for 2017 in early 2018, they were lies, because no one was able to have those numbers that early.

The information of several American “specialists,” swapping over the Atlantic, that Western Europe saw a decline in 2014 is fake. “2014 was a tough year for most EMS companies with revenues in Western Europe declining by 3% while an increase of 3.4% in Central and Eastern Europe (CEE) and Middle East/North Africa (MENA) helped the overall European market post growth of 0.5%” Source: Electronics.ca publications January 18, 2016.

Maybe one should give these American “specialists” a lesson in geography first: Europe ends at the Bosporus, the Anatolian part of Turkey, the Middle East and North Africa are not parts of Europe. You can talk about EMEA, but not about Europe. In such case, the expression EMEA would include all of Africa, not only the Maghreb states.

Other statements in the press were fake as well: “Following the decline back in 2014 – the European EMS industry is forecasted to reach EUR 27.4 billion in 2016. In Western Europe EMS revenues are forecasted to reach EUR 11.7 billion in 2020, up from EUR 10.8 billion in 2015”. Source: Evertiq, December 02, 2016.

Now, let us do a very complicated mathematical operation, which seemingly not everybody can do: In 2015 the EMS industry in Germany, Austria and Switzerland had combined revenues of 7.7 billion Euro, UK and France had 2.3 billion Euro each, Scandinavia had 2.0 billion Euro, Italy 1.4 billion Euro and the Benelux states (for American specialists: this is Belgium, The Netherlands and Luxemburg) had 1.0 billion Euro. Including Ireland, the Iberian Peninsula, Greece and Malta (Yes, there is an EMS in Malta!) as well, Western Europe had revenues of 17.5 billion Euro, whereas Eastern Europe had revenues of 16.46 billion Euro.

Only the French Press were farsighted enough, when they asked the question: “Marché de la sous-traitance en Europe de l’Ouest: pas plus de 11 milliards d’euros cette année?” Source: ViPress.net.

Another “expert” wrote just recently, that there had been a problem in Europe in 2015. He looked at the European EMS numbers in USD. Well, let me tell you, we were not scared here in Europe with a growth rate of 5.7%. In Europe, we calculate most of the revenues in EURO, not in USD. Probably this “expert” missed the dramatic change in exchange rates USD/Euro in 2015. Calculated in USD, the EMS revenues slid by 11.7% against 2014. We did not care.

How did the EMS industry in Europe perform in 2017? This question can be answered only, when the numbers of Foxconn in the Czech Republic (Hungary and Slovakia already published) and of Jabil and Flex in Poland are being published in the country company registers. If one just takes the numbers for 2016 for 2017 as well, one gets to a growth rate of 3.7%. However, this is foolish, as these three big EMS had tremendous jumps in their revenues in the past, to the upside as well as to the downside. Considering this, the 3.7% could easily be 2.6% or 4.9%.

The in4ma database not only contains revenues and employee numbers but as well detailed contact data for each of the 1.705 active EMS companies. In addition, for many companies, the founding years, NACE codes, export ratio, revenues with own products, net profit and many other balance sheet data are saved. Even the companies, which left the market within the last four years, are available. Weiss even discloses all of his sources and is willing to show anybody the insights of his database, as long as numbers given under NDA agreements are not visible.

The in4ma database not only contains revenues and employee numbers but as well detailed contact data for each of the 1.705 active EMS companies. In addition, for many companies, the founding years, NACE codes, export ratio, revenues with own products, net profit and many other balance sheet data are saved. Even the companies, which left the market within the last four years, are available. Weiss even discloses all of his sources and is willing to show anybody the insights of his database, as long as numbers given under NDA agreements are not visible.

If you read about the European EMS industry in future, let the issuer exactly explain to you how he got to the numbers, do not accept every garbage. The in4ma numbers are based on the difficult operation of “addition of revenues of 1705 EMS companies in Europe”. If you have a better way of getting to accurate numbers, write me or meet me at electronica in Munich this year. Contact is possible via www.in4ma.de.

If you read about the European EMS industry in future, let the issuer exactly explain to you how he got to the numbers, do not accept every garbage. The in4ma numbers are based on the difficult operation of “addition of revenues of 1705 EMS companies in Europe”. If you have a better way of getting to accurate numbers, write me or meet me at electronica in Munich this year. Contact is possible via www.in4ma.de.