Near-Sourcing Trend Elevating US Trade With Mexico and Canada as China Is Left Behind

We have been saying for years that near-sourcing was real and that it would mitigate some of the negative economic impact of the Federal Reserve’s interest rate hikes.

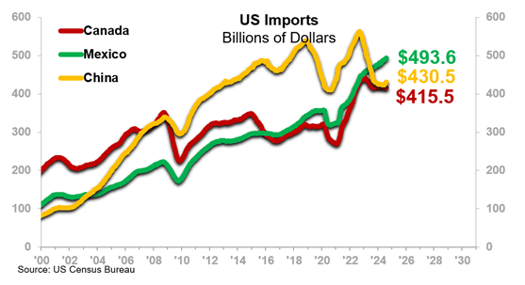

According to the data, this near-sourcing trend is in full swing. If you asked a random person on the street to identify the country “we get the most of our stuff from,” their answer would likely be “China,” and they would be wrong.

We import more from Mexico than China, and we import almost as much from Canada as China.

The chart shows annual US imports from the three respective countries in billions of US dollars.

- US Imports From China recovered after a tariff- and COVID-related dip but then steeply declined again and are now trending just a little bit above the COVID trough.

- Imports from Canada and Mexico fully recovered post-COVID and easily exceed pre-COVID levels. Both are currently “above trend” relative to their pre-COVID trajectories.

- US imports from Mexico continue to rise robustly.

- Imports from Canada have at least tentatively leveled off but are trending well above (23.8%) the trailing 10-year average.

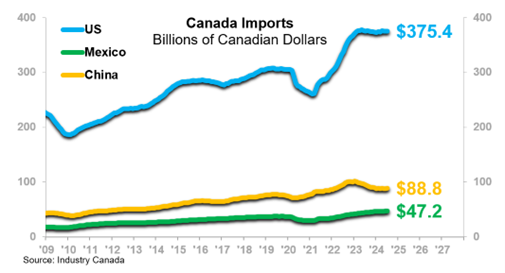

The dynamic has also changed from the Canadian perspective.

- Canada’s imports from the US and from Mexico rose robustly post-COVID, unlike the country’s imports from China.

- Canada’s imports from China have declined in recent years.

- Imports from China are below trend.

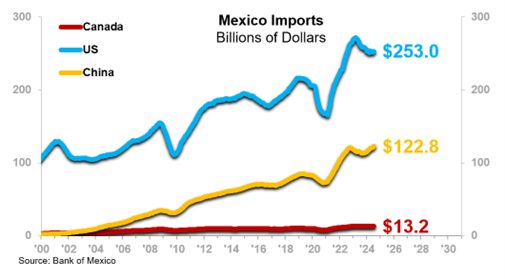

Meanwhile, for the Mexican economy, the trade relationships have not changed much.

- Mexican imports from both the US and China are generally up, and imports from Canada are relatively flat, as has been the general trend since the early 2010s.

For your US company, the near-sourcing trend means generally increased manufacturing opportunities in the US. You may also wish to explore opportunities in Mexico.

For more on how to best position your business to benefit from these near-sourcing opportunities, we have a webinar on this topic for our Insider™ subscribers.