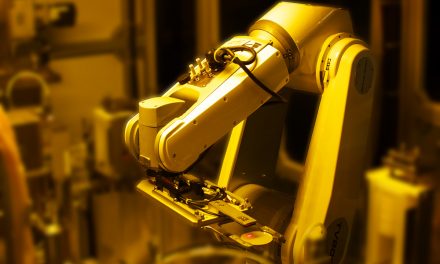

China’s New Growth Strategy Backed by Robots

SOURCE: International Federation of Robotics.

Beijing´s “Third Plenum Meeting” announced technology centered approach

At its recent Third Plenum, China mapped out the direction of the country’s economic policies: Beijing wants to adapt to the new round of industrial transformation by using robots as an engine for growth. China’s success story with industrial robots is unique: the country is by far the largest robot market in the world.

“China’s rapid development in industrial robot automation is extraordinary,” says Marina Bill, President of the International Federation of Robotics. “The operational stock surpassed the 1.5-million-unit mark two years ago, making China the first and only country with such a large industrial robot stock.” The installation of 290,258 units in 2022 alone represents 52% of the global market.

Demand across various industries

To serve this demand, domestic and international robot suppliers have established production plants in China and continuously increased capacity.

Massive investment in the automotive industry has boosted demand since 2010. China has become both the world’s largest car market and the world’s largest production base for cars – including electric cars – with strong growth potential. China is also a major producer of electronic devices, batteries, semiconductors and microchips. Since 2016, the electrical and electronics industry has replaced the automotive industry as the main customer and growth driver of industrial robots in China. Various other industries have also started to expand their capacity using advanced automation technology.

Robots as a new engine for growth

Today, China´s home market still is the biggest single market for Chinese robot manufacturers: “So far the number of exported robots from China is very limited,” says Xiaogang Song, Executive Director and Secretary-General of the China Robot Industry Alliance (CRIA). “Chinese robots going abroad started only a few years ago. According to our statistics, the total number of exported robots is less than 5%”.

“Like any business looking for a new market, Chinese robot companies go where there is demand for their products”, says Song. Usually, Chinese robot companies set up their branches by cooperating with local partners and hiring local staff. It will take time to build brand credibility by raising technology levels and providing better services to meet the needs of foreign markets. In some areas, such as vision systems or AI applications, Chinese companies have advantages based on meeting the needs of accelerating automation in China’s manufacturing sectors. Lower production cost or low cost is also one of the main advantages of Chinese robots.

About China´s “Third Plenum”

China´s Central Committee convened the plenary session, or The Third Plenum, of the 20th National Congress of the Communist Party 15-18 July 2024. It is a platform for the party’s leadership to announce key economic reforms and policy directives related to China’s long-term social and economic progress.

About IFR

The International Federation of Robotics is the voice of the global robotics industry. IFR represents national robot associations, academia, and manufacturers of industrial and service robots from over twenty countries: www.ifr.org

The IFR Statistical Department provides data for two annual robotics studies:

World Robotics – Industrial Robots: This unique report provides global statistics on industrial robots in standardized tables and enables national comparisons to be made. It presents statistical data for around 40 countries broken down into areas of application, customer industries, types of robots and other technical and economic aspects. Production, export and import data is listed for selected countries. It also offers robot density, i.e. the number of robots per 10,000 employees, as a measure for the degree of automation.

World Robotics – Service Robots: This unique report describes marketable products, tasks, challenges and new developments by service robots application. The report includes the results of the annual IFR service robot survey on global sales of professional and consumer service robots and an industry structure analysis including a full list of all service robot producers known to the IFR. The study is jointly prepared with the robotics experts of Fraunhofer IPA, Stuttgart.