New Venture Research Releases Worldwide Electronic Manufacturing Services Market 2024 Report

Nevada City, California – New Venture Research (NVR) announces the imminent publication of its annual electronics manufacturing services report, The Worldwide Electronics Manufacturing Services Market – 2024 Edition.

The worldwide contract manufacturing (CM) market declined in 2023 in reaction to a surplus of sales and overstock in the communications and computer markets. Consumers had depleted stocks in 2022 when there was a perceived demand for extra computing power for backup that was also driven by cheap and available PCs and smartphones. Demand for these products recovered in 1H24.

Although the market diminished by –8.0 percent in 2023, the outlook for 2028 is now estimated to grow at a 4.6 percent CAGR and reach nearly $800,000 million in production value in 2028. The current market size for contract manufacturing is $638,228 million and there is demand for next-generation AI electronics products with advanced generative features.

The CM market was sustained by the strong demand in the industrial, automotive, aerospace/military, and medical markets. Orders for tablets, desktop and notebook computers, and servers, once strong, were set back in 2023 and 1H24 as consumption for replacement

sales had peaked in the previous year. Desktop revenue is expected to be in decline for the next five years, while notebook orders are expected to be in demand again after 2024. The computer industry as a whole (which includes servers and workstations) will see a return to growth over the next four years. The transportation markets will be uneven, depending on the success of EV vehicles that seems inevitable but is being stressed by oversupply.

Figure 2 shows division of the market by type of supplier for 2023 and 2028. It shows that OEMs still dominate the majority of assembly production despite the terrific gains contract manufacturers have made over the years.

Figure 3 compares the worldwide CM market by industry segment for 2023 and 2028. Both EMS firms and ODMs will experience the strongest growth from production in the industrial and automotive market segments. Specifically, EMS companies will find good growth in industrial and medical products, while ODMs are projected to experience a return to growth in cellular servers, storage systems, and smart home, wearable, and A/V equipment.

The largest market in terms of revenue is the communications segment, with its dominance by smartphones that has overshadowed the computer market. The computer market will always see growth driven by upgrades and new developments such as generative AI that will be demanding more raw compute power and storage. The consumer market ranks third and is sustained by strong demand for digital TVs and monitors. The industrial market ranks fourth in size, followed by the automotive and aviation/defense/other transportation segments, and lastly by the medical equipment market. Together these market segments for electronics product assembly totaled approximately $1.3 trillion in assembly revenue, and will grow to $1.5 trillion or higher during the forecast period.

In general, EMS firms will tend to excel in technology-intensive product areas and in complex, low-volume board assemblies. ODMs excel in manufacturing commodity/high-volume products such as motherboards, monitors, handhelds, and consumer electronics.

Table 1 ranks the top ten EMS companies by revenue for 2023. Foxconn continued its extraordinary dominance as the leading EMS firm in the industry, outdistancing its closest contender by almost five times. The top ten leaders accounted for 71.6 percent of total industry revenue, down from 74.0 percent in 2022.

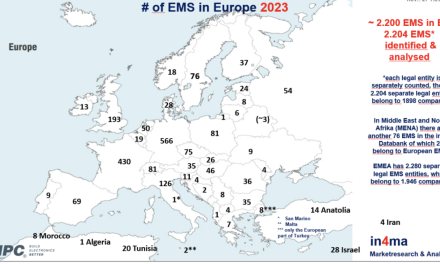

The Worldwide Electronics Manufacturing Services Market – 2024 Edition is over 600 pages in length, and examines the leading EMS and ODM suppliers across 57 countries, 46 product industries, and more than 900 manufacturing locations. For a complete brochure of the report see: https://newventureresearch.com/wp-content/uploads/ems2024-2.pdf/

For more information, contact Randall Sherman at New Venture Research at 530-265-2004. (rsherman@newventureresearch.com) or visit www.newventureresearch.com for more details.