Chandrayaan-3: India’s Moon Landing Spotlights Space Sector Advancements

India’s soft moon landing, steered under the Chandrayaan-3 mission on August 23, highlights the immense technological and R&D prowess of its space sector. Private sector players have also mushroomed in the space/aerospace sector, attracting foreign investments and providing cost-effective satellite services and launchpad solutions, among other capabilities.

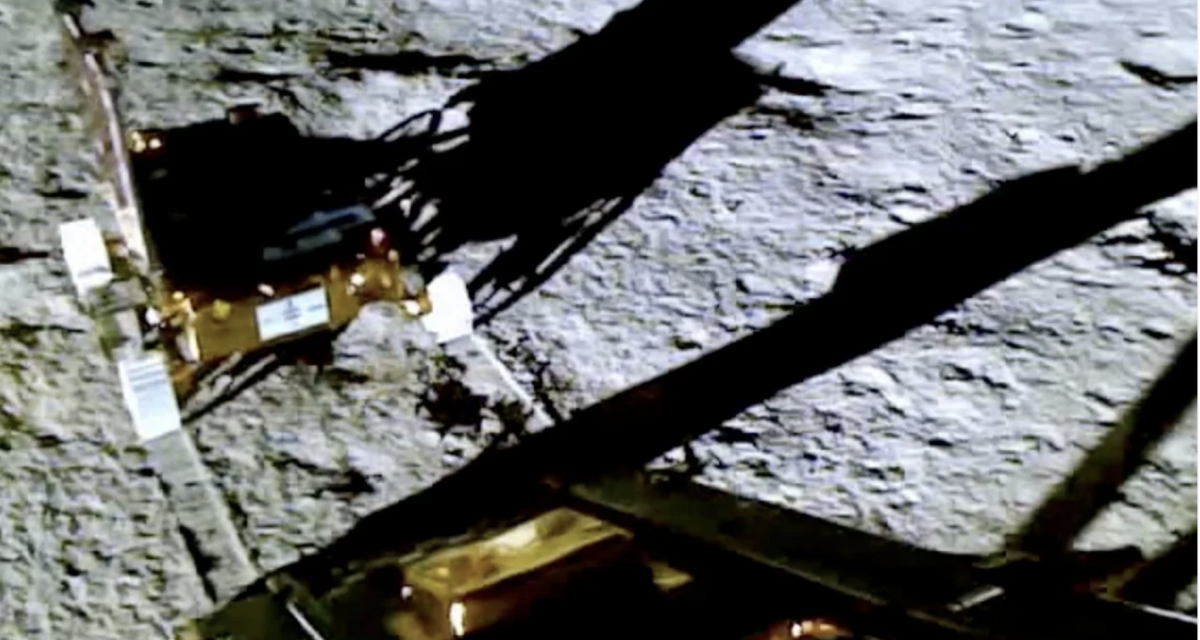

Scientists, space enthusiasts, investors in space stocks, and the Indian public broke out in celebration on August 23 as Chandrayaan-3, India’s budget-friendly lunar mission, successfully ‘softly landed’ its Lander Module, Vikram, near the Moon’s south pole, 6.03PM local time. The spacecraft is named after the cosmic ray scientist Vikram Sarabhai, considered by many to be the founder of India’s space program.

The Indian Space Research Organisation (ISRO) had launched its third lunar mission about a month prior, on July 14. The Vikram Module has now successfully deployed the Rover that will conduct on-site chemical analysis of the lunar surface while it traverses the terrain. Both the Lander Module and the Rover are equipped with scientific instruments designed for experiments on the lunar surface. Chandrayaan-3’s mission is slated to last for one lunar day, equivalent to 14 Earth days.

Chandrayaan-3 Lunar Mission: Details from ISRO

Chandrayaan-3 serves as a subsequent mission to Chandrayaan-2, and demonstrates India’s capability for secure lunar surface landing and ‘roving on the lunar surface’. This mission contains a Lander and a Rover configuration.

The Lander is equipped with various payloads, including Chandra’s Surface Thermophysical Experiment (ChaSTE), designed to gauge thermal conductivity and temperature levels. Additionally, the Instrument for Lunar Seismic Activity (ILSA) is employed to measure seismic activity around the landing area, while the Langmuir Probe (LP) helps estimate plasma density and its fluctuations. NASA’s passive Laser Retroreflector Array has also been included for lunar laser ranging research.

The Rover carries specific payloads such as the Alpha Particle X-ray Spectrometer (APXS) and the Laser Induced Breakdown Spectroscope (LIBS). These instruments work together to determine the elemental composition in the immediate vicinity of the landing site.

Source: ISRO, Government of India

Why India’s lunar exploration matters

Space exploration is now a business, and the southern pole of the moon holds significant value due to the presence of water ice. Experts anticipate that findings from lunar missions could be vital for sustaining potential lunar settlements, mining operations, and even future expeditions to Mars. Overcoming challenges like prohibitive costs and frontier technology applications will propel growth in this sector.

The success of Chandrayaan-3 at a frugal budget of INR 6.15 billion (US$74.43 million) is no mean feat and comes after Russia’s own Luna-25 mission, costing roughly US$200 million by some estimates, ended in failure just days prior. Earlier this year, in April, a private Japanese lunar mission also announced that its spacecraft had likely crashed in an attempt to land on the Moon.

The Chandrayaan-3 budget allocation covers everything from the spacecraft and launch vehicle to the critical ground support facilities. Its more expensive predecessor, Chandrayaan-2, was successfully inserted into lunar orbit on August 20, 2019, with a seven-year expected lifespan. According to ISRO, Chandrayaan-2 will map the minerals and water molecules in the Moon’s Polar regions, “using its eight state-of-the-art scientific instruments” over the course of this period.

Meanwhile, ISRO has filed over 370 patents across multiple technology domains, from electronics, mechanical, optics, to chemical, etc. The ISRO patent portfolio has 193 active patents [2006-2022], with 93 applications under examination as of public records published April 2022. ISRO has also registered foreign patents in China, Russia, Europe, Japan, Singapore, and the United States.

Opportunities and capabilities in India’s space sector

ISRO is the sixth largest space agency in the world and India is witnessing a new era of space-related science and research, with applications for space and aerospace technology. This has emerged in an environment that enjoys government support, new knowledge frontiers, and mushrooming start-ups with access to diverse funding opportunities.

According to Invest India, the Indian space sector could grow from US$9.6 billion in 2020 to US$13 billion by 2025, to capture 10 percent of the global space economy by 2030. Over 400 industrial firms, both conglomerate enterprises and SMEs, are engaged in the development of subsystems for space launch and ground infrastructure under ISRO guidance. This positions India as the fifth-largest nation in terms of registered space companies.

As advancements continue to unfold in satellite communication and various other domains like geospatial data-driven services, the call for space-based solutions is growing. Consequently, the demand for participants to step into both upstream and downstream segments of the space industry to deliver commercial solutions is on the rise.

Bangalore, the capital of Karnataka, is among the top cities in the world attracting foreign investments in aerospace and defense. India also benefits from strengths in adjacent industrial sectors—machine tools, capital goods, and IT and software sector.

India allows up to 100 percent FDI in satellites (establishment and operation thereof) under the government approval route, subject to ISRO/Department of Space guidelines.

Government support

In recent years, India has pushed for private sector participation in its space sector. The government wants Indian space companies to increase their share of the global launch market by fivefold, a decade-mission encouraged by Prime Minister Narendra Modi.

The central government has backed private space technology players for funding, access to tech, and infrastructure. Space-tech start-ups will benefit from a 0 percent GST regime, following the July 2023 meeting of the GST Council. In January this year, Microsoft announced it would collaborate with ISRO. The year prior, a budget of US$137 billion was earmarked in the 2022-23 union budget for the Department of Space.

GST exemption on satellite launch services will be extended to private sector organizations, including startups, in addition to ISRO, Antrix Corporation Limited, and New Space India Limited (NSIL).

Multiple sector policies, including the Space Activities Bill, are in the pipeline.

ISRO has signed six agreements with four countries to launch foreign satellites between 2021-2023. These could earn India up to US$141 million in revenue.

Areas where the Government of India has encouraged private sector involvement include setting up of ground stations for space crafts, space-tech applications, and small satellite segment and component manufacturing.

Interestingly, India’s negotiations with Australia for a CECA also covers space cooperation.

Private sector role catapulted by space-tech start-ups

India’s space-tech start-ups have raised US$205 million in funding between 2014 and July 2023, according to INC42, across more than 30 deals. A Reuters report said that US$119 million were injected into Indian space-tech start-ups in 2022; this figure was just US$38 million in the years to 2017. According to data from apex industry body, the Indian Space Association (ISpA), by 2022, space-related start-ups in the country had received a cumulative US$256 million.

Per reporting in The New York Times, India has registered 140 space-tech start-ups as of July 2023; this number was just one in 2012.

Leading space-tech start-ups in India operate in both the space and aerospace sectors. The products, services, and research offered by these start-ups include self-designing satellites, launch vehicle subsystems, drones (Aadyah Aerospace), launchpad (Agnikul Cosmos), satellite-data and analytics services (Satsure), space-to-ground laser communications (Astrogate Labs), rocket propulsion technology (Bellatrix Aerospace), satellite and launcher interfaces, design and development of space-qualified solar arrays (Dhruva Space), space debris detection (Digantara), multi-sensor all-weather imaging without atmospheric interference via satellite (GalaxEye Space), satellite servicing and space mechanics (InspeCity), etc. In March 2023, Pixxel, a space data company that develops a network of hyperspectral earth imaging satellites, won a five-year contract from the US National Reconnaissance Office.

Multiple satellite launches were recorded in India in 2022. India also had its first private rocket launch on November 18, 2022—the Vikram-S—built by Skyroot Aerospace from Sriharikota, whose investors include Sherpalo Ventures and Singapore’s GIC.

India’s space sector poised for greater foreign investor interest

India’s space sector stands out as a dynamic destination for foreign investors seeking to be part of pioneering innovations, lucrative markets, and game-changing advancements. The sector boasts government support, strategic scientific partnerships, a cost-effective approach, growing talent pool, favorable regional policies, and a rapidly growing tech-led start-up ecosystem. As India’s space sector continues to soar, foreign investors have the chance to ride the wave of growth and contribute to shaping the future of space exploration and technology.