Transportation Market Update – May 2023 Air and Sea Freight

Posted by Jennifer Read | May 30, 2023 | Analysis, EMS, Supply Chain

AIR FREIGHT

Air cargo had a volatile first quarter.

In March, overall demand slipped back below pre-Covid-19 levels and most of the indicators for the fundamental drivers of air cargo demand are weak or weakening.

The stabilization of air freight is confirmed with tonnages and average freight rates changing little over the past weeks.

But when looking at regionalized market data, it is interesting to see significant variations across trades:

- According to data from WorldACD in the first quarter of 2023, the global air freight market fell by 11% compared to Q1 2022.

- However, in detail, the evolution of tonnages transported fluctuates by -18% from America North, the most affected region, at +1% from Latin America and Africa.

Europe recorded a decline of -5% and Asia Pacific -16%.

Also instructive, the fall in volumes between Asia Pacific and North America (-21%) is much more marked than to Europe (-10%).

Finally, the heaviest shipments are those that show the greatest decline: -18% for shipments over 5,000 kg, against +3% for shipments under 1,000 kg.

Implicit is probably the effect of the modal shift towards the sea, since the drop in ocean rates.

SEA FREIGHT

Facing the historic increase in capacity, shipping companies have an often underestimated lever: the drop in the speed of container ships.

Indeed, sea freight companies have reduced the speed of their vessels since mid-2022.

The larger vessels have slowed their average speed by about 1 knot since this period, which represents a significant reduction in the effective supply of vessels: if we take 14 knots as the basis for comparison of navigation speed, it is therefore an average increase of 7% in transit time.

These voluntary slowdowns are above all responses, on the part of the companies, to the rise in the price of marine fuels, but also to the weakness of the market.

One way to reduce capacity and thus slow down the fall in rates. As a reminder, Drewry estimates that global container fleet capacity will grow by 4.7% this year.

Besides, shipping lines continue to void sailings to balance the supply.

They are also slow steaming—or taking longer routes—via the Cape of Good Hope on the backhaul legs of major East-West services.

This will impact transit-sensitive commodities.

While congestion is mostly gone, the need for some flexibility remains as blank sailings and service adjustments continue to impact lead times.

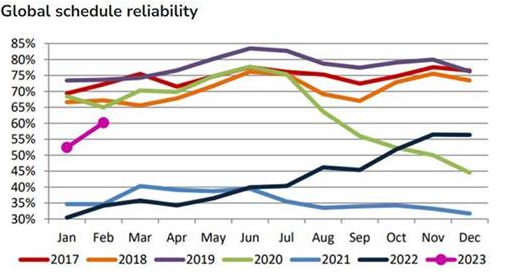

In the meantime, schedule reliability is improving.

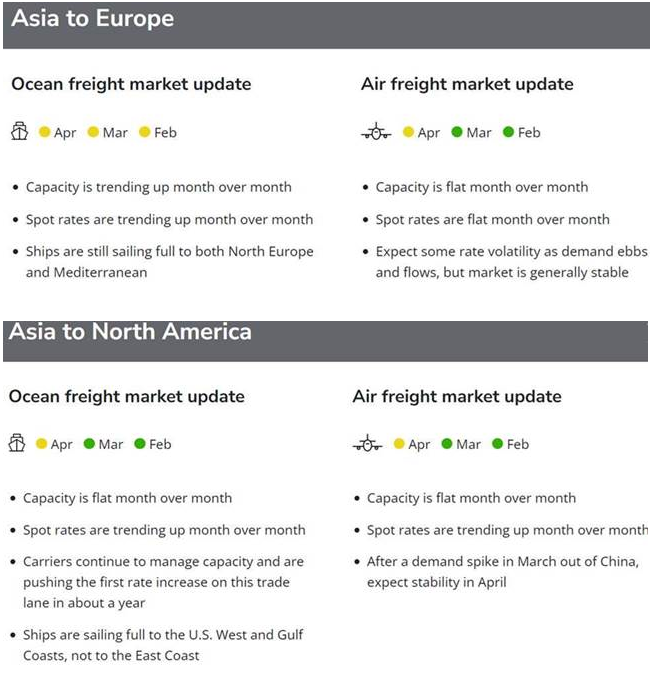

In a nutshell: