Rocky Road to Recovery in Mexico, Says Deloitte

According to a recent Deloitte report, COVID-19 deepened the contraction of the Mexican economy. As manufacturing and consumption bounce back, sustained demand for services can help recovery. But a policy push is needed.

THE global pandemic came at a time when the Mexican economy had contracted for five straight quarters due to a variety of factors such as deceleration in investment and private consumption and uncertainty around the free trade agreement with the United States and Canada.

The COVID-19 crisis accelerated this trend, resulting in the largest contraction since the Great Depression of 1929. The forecast for GDP growth this year is -9.0% annually. The economy saw a steep decline of 17.0% from the first quarter to the second, followed by a partial recovery of 12.1% in the third quarter (figure 1). However, the output level is still 8.6% lower than the previous year.

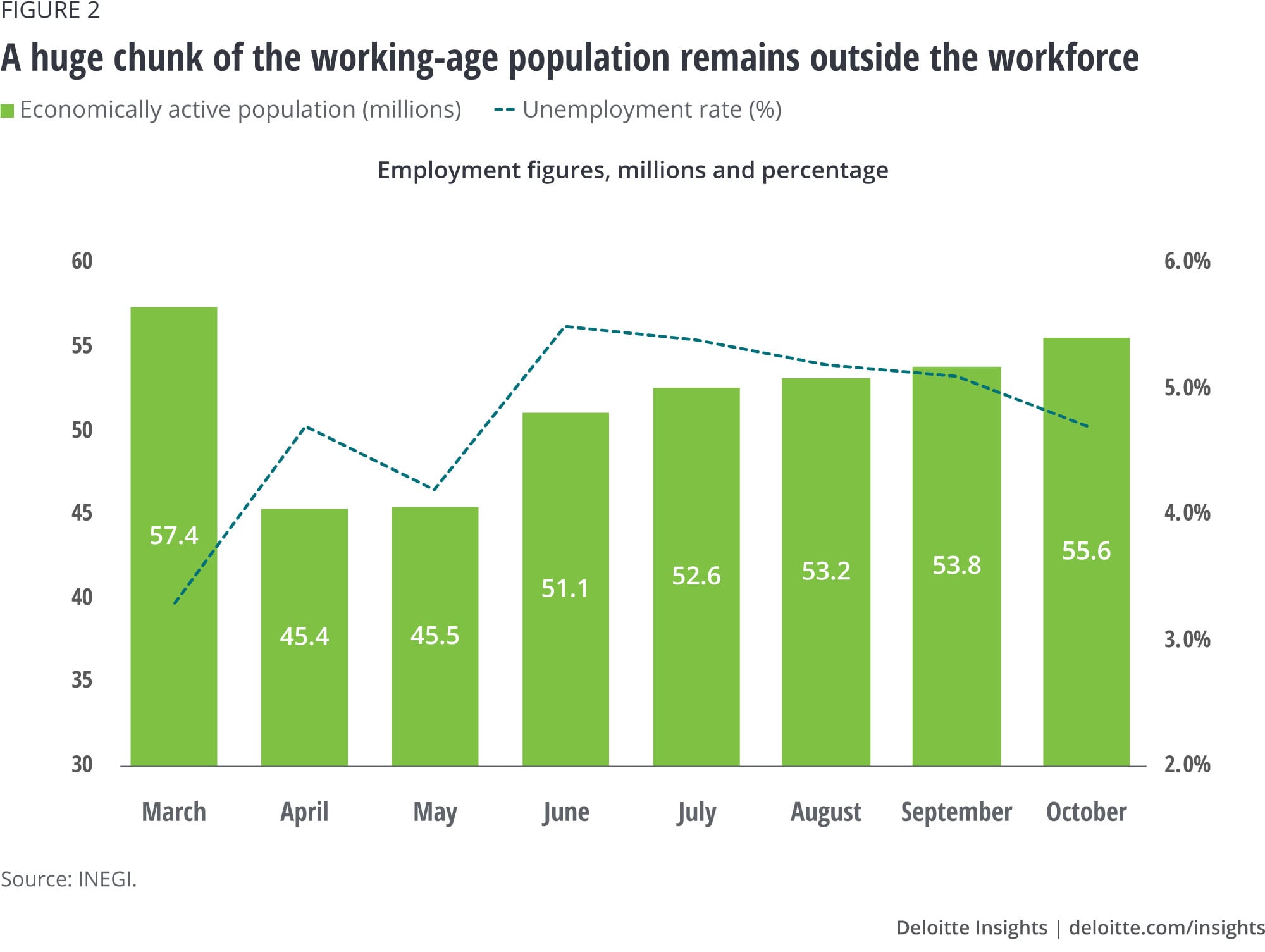

The pandemic has also had a substantial effect on the Mexican labor market. Between April and May this year, 12.5 million people left the labor force and unemployment rose to 4.5%, up from 3.3% in March. The pandemic shrunk the size of the economically active population from 60.5% in February to 47.5% in April.1 By now, partial recovery of the Mexican economy has helped bring 10.2 million back to work while nearly 2.3 million workers have yet to return (figure 2).

Nevertheless, there are other factors to consider. The vast majority of those who are reintegrating with the labor force are joining the informal market. Besides, the number of people working part-time hours had doubled to 15.7% in October compared to 7.5% in January. This exemplifies how, despite the recovery, working conditions have become more precarious in the country.

The sharp fall in the economy observed this year will have a smaller carry-forward effect in 2021—a year the world will be excited to see the arrival of COVID-19 vaccines, but also one that faces great challenges. Above all, due to the lack of fiscal support and the resurgence of COVID-19 cases, which will affect production and employment once again, the road to recovery will be fraught with uncertainty.

Manufacturing and services: Diverging paths to recovery

Manufacturing, one of the main drivers of growth in the past decade, registered a significant decline in output as the restrictions imposed due to the pandemic curtailed demand, both at home and abroad. Additionally, the lockdown also reduced output across industries such as automotive and electronics, among others.2 In the automotive industry, for example, production of cars went from 320,000 units in January to only 3,000 units in April—a fall of almost 100%. However, by October, automobile production had reached 347,000 units. 3

The gradual reopening of the economy and normalization of trade flows between the United States and Mexico have helped a faster recovery in manufacturing compared to the rest of the economy (figure 3). As economic activity picked up pace in the United States, so did the manufacturing output of Mexico (especially the automotive sector), with many industries reaching their prepandemic production levels.