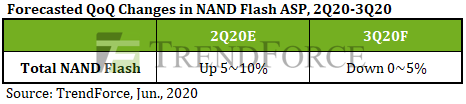

Changes in NAND Flash Prices to Be Limited in 3Q20 as New Game Console Releases Projected to Compensate for Weakening Cloud Demand, Says TrendForce

According to the latest investigations by the DRAMeXchange research division of TrendForce, despite the reduced demand for consumer electronics and smartphones as a result of the COVID-19 pandemic, the NAND Flash market showed a short supply in 1H20, thanks to the corresponding rising demand for cloud services and distance education, as well as increased inventory procurement by some clients concerned with a possible breakage in the supply chain. On the whole, SSD currently dominates NAND Flash demand, while demand from the eMMC, UFS, and wafer markets, which are related to smartphones and consumer electronics, remains relatively sluggish.

Demand from game consoles and Chromebooks is expected to shore up sluggish data center NAND Flash demand

TrendForce analyst Ben Yeh indicates that negotiations for 3Q20 NAND Flash contract prices are currently ongoing. According to TrendForce’s observations, the planned year-end release of the new consoles remains unchanged, and the stock-up activities related to the first-time SSD adoption by game console makers that began in 2Q20 are expected to peak in 3Q20. In addition, the demand for Chromebooks has been robust due to the GIGA School proposal from Japan and the reinforced European and American tenders.

However, the impact of urgent orders generated by the pandemic has started to decelerate after the gradual easing of lockdowns in various countries. In particular, there will likely be a reduction in the demand for enterprise SSDs, products that experienced the highest demand in 1H20, since they are affected by the adjustments in the inventory level of server barebones and by the deferred build-out schedule of data centers. Given that the demand for commercial notebook computers has also gradually stabilized, the procurement side, including OEM/ODM buyers, is expected to conservatize their purchasing demand in 3Q20. On the other hand, demand from the retail end and from smartphones is expected to somewhat bounce back in 3Q20, given the relatively low base period in 2Q20, though with weaker momentum compared to 2019.

Changes in NAND Flash prices will be limited due to the balanced supply and demand in the market in 3Q20

Since the impact of the pandemic on the overall supply bit growth has been limited, while NAND Flash suppliers currently keep a fairly healthy level of inventory, the overall NAND Flash market is projected to transition from a state of relatively tight supply to a state of balanced supply and demand. As such, contract prices of mainstream NAND Flash products are projected to experience a limited decline in 3Q20 (that is, ranging from holding steady, to a slight QoQ drop). As for the more price-sensitive NAND Flash wafer market, prices there may register noticeable MoM declines in 3Q20 due to the weakening demand from module makers.

Regarding the demand situation in 4Q20, TrendForce projects that component stocking related to Chromebooks and the next-generation game consoles (which now receive a lot of market attention) will have declined from their peaks by then; the demand for commercial notebook computers is expected to further weaken as well. Besides these factors, server OEMs and cloud service providers still need time to adjust their inventories. They will unlikely regain their procurement momentum in 4Q20. Although sales of smartphones and retails sales of storage products are projected to return to a QoQ growth for 4Q20, they will be unable to compensate for the reduction in SSD demand. Hence, TrendForce believes that contract prices will keep falling and experience a wider magnitude of declines for different types of NAND Flash products in 4Q20.