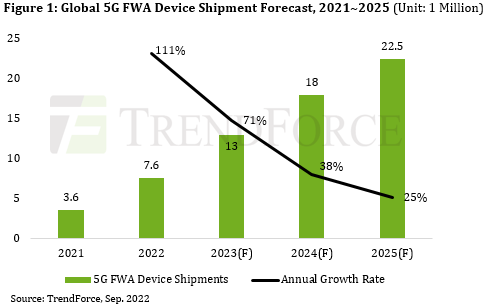

5G FWA Device Shipments Forecast to Reach 7.6 million Units in 2022, N. America and Europe Take Lead in Injecting New Business Opportunities into Supply Chain, Says TrendForce

According to TrendForce research, shipments of 5G FWA devices will reach 7.6 million units in 2022, an annual increase of 111%, due to the expansion of 5G coverage and growing market demand for Fixed Wireless Access (FWA) services. 5G FWA device shipments in 2023 are estimated at 13 million units. At present, Nokia, Huawei, Casa Systems, and TCL have launched relevant solutions, using Qualcomm, MediaTek, and UNISOC made chips. Taiwanese players include Arcadyan, Zyxel, Sercomm, Wistron NeWeb, Askey, and Alpha Networks. As installed capacity increases, new demand is created for communication equipment manufacturers and new business opportunities become available to upstream component suppliers.

5G FWA meets the growing demand for broadband data access primarily due to key technology advancements such as the new 5G NR (New Radio) interface, Network Slicing, Massive MIMO, and Quality of Service (QoS) guarantees. 5G FWA converts 5G signals into Wi-Fi signals through base station construction and paired FWA devices as user Internet connections.

5G FWA emphasizes support for home and business applications, facilitating wide bandwidth and low-latency connections and becoming an alternative to fixed broadband connections. 5G FWA has an opportunity to become a powerful application in the arsenal of telecom operators used to attract broadband users. In addition to improving user experience, customer loyalty can be greatly enhanced through bundling diversified services such as Wi-Fi Mesh, video, games, etc.

Governments offer broadband subsidy policies to incentivize telecom operators to expand FWA deployment

5G FWA offers more advantages than fiber-to-home in terms of infrastructure and maintenance costs including in ground excavation, burying cable, and subsequent installation in buildings and households. Construction timeframes are long and the process requires continuous investment of manpower. The difficulty of secondary construction is also high. In contrast, the deployment of 5G FWA takes less time and the cost of manpower and equipment is lower. As governments in many countries actively invest in the development of broadband construction and regulators see wireless as an alternative to wired connections, more and more operators are expanding FWA investment to quickly provide broadband Internet services. After the advent of 5G FWA, it has become a solution for accelerating and expanding the infrastructure of high-speed fixed networks in many countries.

The U.S. Federal Communications Commission (FCC) provides the Rural Digital Opportunity Fund (RDOF) with $9 billion in subsidies to cable, fixed wireless, and satellite providers while the European Union proposes a goal of 100Mbps for European households by 2025 and a vision of digital transformation by 2030. European household network speeds need to reach Gbps levels while simultaneously accelerating 5G network coverage in cities and transportation routes, study FWA as a national broadband goal, and open mid-band spectrum licensing to reallocate and utilize frequency bands, which is helpful for rural area and suburban community network coverage, reducing the digital divide. For regions that are slow to develop economically such as central/southern India, Indonesian Borneo, Sumatra, and the western plateau of Vietnam, the deployment of 5G FWA is expected to lower the threshold for the future construction and maintenance of high-speed networks.