Electronic Component Sales Sentiment Plunges in November Outlook, Reports ECIA

By Dale Ford, Chief Analyst, ECIA

Dale Ford

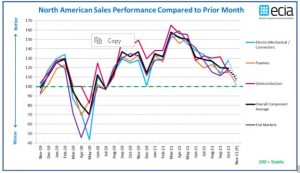

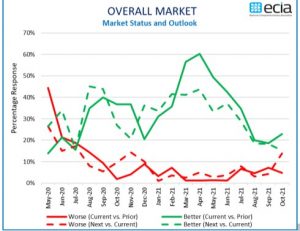

After showing a relatively stable, modest decline in overall sentiment between June and October, the November outlook in the latest results from ECIA’s Electronic Component Sales Trend (ECST) surveys points to a strong decline in expectations in the coming month. While the average electronic component sales sentiment index declined by an average of 3 points per month in the prior four months, the average drops by over 12 points looking from October to November. The overall component index still shows a positive sentiment looking ahead. However, the outlook for November has now declined to 107.3 from its peak in March of 157.7. Looking at expectations from the perspective of the end market average, the decline is more precipitous as it collapses from 118.1 in October to a 101.3 expectation for November. From the end market perspective, the outlook for November monthly growth is essentially flat.

The overall trend in sentiment between Semiconductors, Passives, and Electro-Mechanical/Connector components is essentially aligned between September and November with only 5 points separating the highest and lowest index result for November. Comparing between the three groups surveyed, Distributors and Manufacturer Representatives report a more pessimistic outlook than Manufacturers. Reviewing the various component sub-categories, Analog ICs and Discrete Semiconductors show the most promising expectations for growth in November. Otherwise, the component subcategories have similar low growth expectation looking ahead. Given that a score above 100 indicates growth expectations, the most recent survey results still show a positive outlook. However, market growth appears to have moved to a new, lower phase of sentiment compared to the prior 15 months.

The detailed monthly survey measurement of expectations for end-market demand shows Automotive Electronics as the only market dropping below the 100 threshold. However, the outlook for Medical Electronics and Mobile Phones is only slightly above 100. The greatest optimism looking to November is

found in Industrial Electronics and Consumer Electronics. Looking at the market and component indices from the longer-term perspective it is seen that there is an element of seasonality in the month-to-month growth expectations. Expectations for November saw a similar decline in 2020 with the sentiment reported for the current month lagging by a month and showing a notable decline in December. The electronics and electronics component markets have exhibited this typical, seasonal pattern of growth through most of its history. Average fourth quarter growth is usually the lowest quarter during the year. So, the index results for November can be explained to a degree by seasonal factors. However, there are other factors that are likely stunting growth expectations.

The overall economy, including the IT and electronics sectors, has been weighed down by heavy challenges that have increased over the course of 2021. In addition to a strong climb in inflationary pressures accompanied by a slumping consumer confidence index and labor shortages, the overwhelming supply chain crisis has harmed sales in every sector of the economy. With no end in sight to the stalled supply chain, manufacturers and retailers face an extremely risky and uncertain future. On top of all of this, the ongoing debate in congress over the budget and its implications for the fundamental structure of the U.S. economy has placed all industries on a very unstable situation. Even though the stock market continues to climb, there is a sense that the economy is holding its breath as it waits to see the consequences of government actions.

Comparing the results between the September and October surveys indicates renewed pressure on lead times with the most recent survey results showing an increase in those expecting longer lead times in Passives and Electro-Mechanical/Connector components. This is especially true for Capacitors with more modest increases in Connectors and Electro-Mechanical components. A significant increase in the supply of DRAM components has provided relief for lead times in that segment with relief found in Analog ICs and Discrete semiconductors as well. On the other hand, MCUs continue to see an increased imbalance between supply and demand, especially in automotive electronics.

The ECST survey provides highly valuable and detailed visibility on industry expectations in the near-term through the monthly and quarterly surveys. This “immediate” perspective is helpful to participants up and down the electronics components supply chain. In the long-term, ECIA shares in the optimism for the future as the continued introduction and market adoption of exciting new technologies should motivate both corporate and consumer demand for next-generation products over a growth cycle that still appears to have legs to go an extended distance.

The complete ECIA Electronic Component Sales Trends (ECST) Report is delivered to all ECIA members as well as others who participate in the survey. All participants in the electronics component supply chain are invited and encouraged to participate in the report so they can see the highly valuable insights provided by the ECST report. The return on a small investment of time is enormous!

The monthly and quarterly ECST reports present data in detailed tables and figures with multiple perspectives and covering current sales expectations, sales outlook, product cancellations, product decommits and product lead times. The data is presented at a detailed level for six major electronic component categories, six semiconductor subcategories and eight end markets. Also, survey results are segmented by aggregated responses from manufacturers, distributors, and manufacturer representatives.