2022 to Mark the Third Year in a Row of ≥20% Growth for the Foundry Market

Chinese foundries forecast to continue to hold less than 10% of the total foundry market.

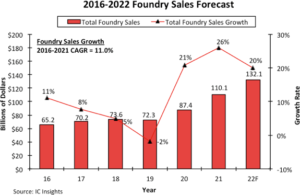

IC Insights’ forecast for the foundry market through 2026 was part of its recently released 1Q Update to the 2022 McClean Report. The Update also included analyses of the top-25 2021 semiconductor suppliers, semiconductor industry capital spending, IC industry capacity, the automotive IC market, and detailed forecasts for the DRAM, flash, MCU, MPU, and analog IC product segments. Figure 1 shows the worldwide total (pure-play and IDM) foundry market forecast from 2016 through 2022.

Figure 1

After dropping 2% in 2019, the foundry market logged a strong 21% rebound in 2020 as application processor and other telecomm device sales into 5G smartphones acted as strong drivers. The foundry market continued its growth surge in 2021, registering a 26% jump. If IC Insights’ 20% increase now forecast for the foundry market in 2022 comes to fruition, the 2020-2022 timeperiod would mark the strongest three-year growth span for the total foundry market since 2002-2004.

Before 2019, the foundry market last declined in 2009 (-11%). IC Insights does not expect another pure-play foundry market decline over the next five years. It is interesting to note that in the past 18 years (2004-2021), the pure-play foundry market grew 9% or less in nine of those years and by double-digit rates in the other nine years (40% in 2004, 20% in 2006, 43% in 2010, 16% in 2012, 14% in 2013, 13% in 2014, 11% in 2016, 21% in 2020, and 26% in 2021). It appears that, over the past 18 years, it has been either boom or bust (or at least moderate growth) for the IC foundry market.

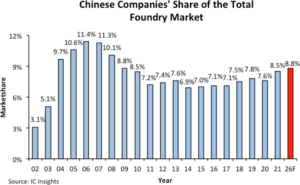

Chinese Companies’ Share of the Foundry Market

Nine of the top-12 foundries in 2021 were based in the Asia-Pacific region. Europe-headquartered specialty foundry X-Fab, Israel-based Tower (now expected to be acquired by Intel), and U.S.-headquartered GlobalFoundries were the only non-Asia-Pacific companies in the top-12 ranking last year.

In 2020, a 25% increase in sales by SMIC was not enough to prevent a decline of the Chinese foundries’ share of the total pure-play foundry market to 7.6% (Figure 2). In 2021, SMIC’s sales jumped by 39% as compared to a total foundry market increase of 26%. Moreover, Huahong Group saw its sales growth rate last year increase at twice the rate as the total foundry market (52% for Huahong Group as compared to 26% for the total foundry market). As a result, the Chinese company share of the pure-play foundry market increased by 0.9 points to 8.5% in 2021.

IC Insights believes that the total Chinese company share of the pure-play foundry market will remain relatively flat over through 2026. Although the China-based foundries plan to take advantage of the huge amount of government and private investment that will be flowing into the Chinese semiconductor market infrastructure over the next five years (which became evident with the huge jump in SMIC’s capex outlays in 2020), it is unlikely they will be able to compete for leading-edge foundry business, especially considering that SMIC was placed on the Entity List by the U.S. Combined, the Chinese foundries are forecast to hold 8.8% of the pure-play foundry market in 2026, a level that would be 2.6 points less than their peak share of 11.4% in 2006.

Figure 2