Stretchable electronics: keeping it simple brings success

By Dr Khasha Ghaffarzadeh Research Director & Mr James Hayward Senior Technology Analyst, IDTechEx

first published by IDTechEx on Printed Electronics World

Stretchable and conformable electronics to reach $600M by 2027 Stretchable and conformable electronics (SCE) is already commercial. Interestingly, the commercialized parts are often not fancy or high-end. Instead, they are down-to-earth elements performing a simple yet useful function in a hybrid system. The IDTechEx Research report ‘Stretchable and Conformal Electronics 2017-2027’ finds that the market, across all its diverse components and applications, will continue its growth, reaching $600M by 2027.

In this article, we will provide high-level descriptions of the activity taking place for various stretchable and conformable components. To learn more we refer you to the IDTechEx report on ‘Stretchable and Conformal Electronics 2017-2027’. This report provides a comprehensive and insightful analysis of this diverse emerging industry, assessing more than 32 product areas, analysing more than 16 different stretchable materials/components, covering the progress of more than 87 companies and 25 research institutes, and providing ten-year market forecasts segmented by more than 7 application and 15 material/component areas.

Keeping it simple works

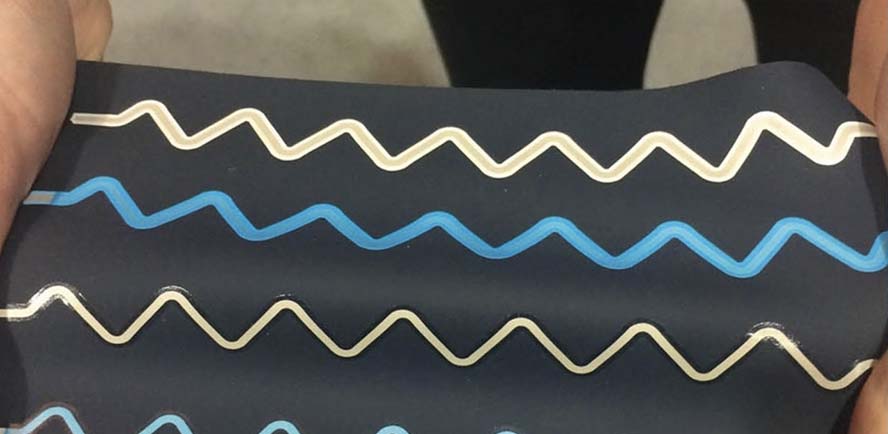

Conductive materials are the most basic constituent of SCE, yet they are the most advanced commercially. In their simplest use case, stretchable conductive materials act as interconnects. Here, choices (solutions) are aplenty, ranging from metal-coated yarns/fibres to fine wires and to printed ink-based solutions.

The yarn, fibre or wire-based solutions are the most common approach in e-textiles today largely thanks to their robustness. These solutions achieve their stretchability through pattern design and not intrinsic material properties. They are here to stay as the e-textile industry expands.

Conductive ink-based solutions are an alternative approach. Their advantage is that they are a post-production step, requiring little changes to existing processes. Furthermore, ink technology is highly adaptive, meaning that a wide range of conductivity and cost requirements can be addressed by changing the filler material/morphology or the formulation.

This technology is rapidly evolving with each generation offering substantially improved stretchability and washability. The commercialization process has been largely driven by a technology push by ink suppliers. The market has, however, already been seeded over the past three years or so and, as suggested by our survey of suppliers, 2018 will be the year during which growth is expected to take off.

In the SCE space, the use of stretchable printed conductive inks is not limited to just e-textiles. Take medical devices as an example. Here, inks can enable stretchable wires, enabling, for example, more convenient solutions for patients in ECG monitoring systems (or similar). Or take in-mould electronics (IME) as an example. Here, inks that can survive a major on-off stretching as well as forming/moulding conditions are required. IME itself has had several false starts in the past, but is now once again in the final stages of various qualification processes for automotive and home appliance applications. Success here will translate in notable revenue for the SCE market.

Interestingly, when it comes to IME, the choice of material is expanding to enable more functions. Transparent conductive films (TCFs) will play a key role here. This is because they will help bring pro-cap touch sensing capability to 3D shapes using the high-volume IME process. For some TCF materials, this is already a small market outlet whilst we expect the market to also materialize soon for other IME-compatible TCF materials. This too is a space to watch.

Stretchable conductive inks also find use beyond just interconnects. Indeed, many are deploying them as sensors. Here, the high conductivity enables reading weak body signals whilst stretchability enables a conformal and wearable solution. This application has already found commercial use too and there is much more to come. Stretchable inks can also be used in other ways. One recent prominent example is in their use as heaters in the US team’s clothes made for the opening ceremony of the winter Olympics. Here, specialized carbon inks (with positive thermal coefficient) are used together with silver inks as electrodes.

For a comprehensive assessment of the conductive ink market refer to our report ‘Conductive Ink Markets 2017-2027: Forecasts, Technologies, Players. This report provides the most comprehensive and authoritative view of the 1900 tpa conductive inks and paste market, giving detailed ten-year market forecasts segmented by application and material type. The market forecasts are given in tonnage and value at the ink level.

Success beyond simple conductors

Stretchable sensors are of course not limited to ink-based ones. Indeed, there are many other varieties. In the low strain end, we have conformable sensors that are commercialized. One example would be printed piezoresistive sensors. The sensors can conform to the topography of a patient’s tooth, to the contours of a person sleeping, or to the shape of a customer’s foot.

In the high strain end, too, we are seeing increased commercial progress. Here, we have highly-stretchable resistive or capacitive sensors. These sensors will essentially extend the strain sensing capability beyond the limitations of conventional gauges like metal foils.

Here too the market has been characterised by technology push. Indeed, the burden of seeding and educating the market has fallen on the suppliers. They have however made good progress afters years of low-key searching, and compelling concepts have been suggested ranging from fitness/movement measurements to animal tagging to forest monitoring to controlling 3D printers or to keeping watch on various industrial equipment. These sensors are still expensive on a per unit basis despite their simple structure. This will inevitably change when larger orders appear, enabling investments in volume production.

These sensors are part of the third wave of wearable sensors. The first wave is characterised in long-established wearable products such as hearing aids or GPS devices. The second came from sensors adapted from another industry, such as inertial measurement units from smartphones. Finally, the third wave comes from “made-for-wearable” sensors, developed with key properties of wearable devices in mind. This sector remains relatively small today, but as different wearable technology sectors begin to mature, this will become the largest sector within the next decade, accounting for around half of the total revenue from all wearable sensors. This forecast and these themes are described in IDTechEx Research’s report Wearable Sensors 2018-2028: Technologies, Markets & Players.

Rising up the complexity ladder

Most commercial success, to date, has been based on discreet stretchable components, solving specific challenges in specific applications/industries. Most commercial SCE solutions, to date, are also simple elements, acting often as interconnects or sensors. This hybrid approach in which the SCE component is just one small part of a bigger whole is set to persist.

This is not to deny notable progress in other more complex areas of SCE. Stretchable printed circuits boards are already with us commercially. These can be achieved using new materials or, more commonly, with thinned meandering lines connecting rigid islands. Various printed displays- electrophoretic and even OLED- have bee demonstrated at various shows. Different approaches for ahieving stretchable and/or textile-based energy storage solutions have also been devised, utilising fibres, special pattern designs or novel materials. Whilst progress is rapid and exciting in many frontiers here, these technologies are not yet out of the lab.

The picture in fact is not too dissimilar to what we witnessed in printed electronics, an industry that has many more years of commercialization experience. Here too all manners of devices and components could be printed including displays and transistor circuits. Commercial success however came first when simple printed element solved a specific problem in a specific application: printed silver lines in solar cells, membrane switches or bus bars; printed disposable electrodes and enzymes in glucose test strips; printed peizoresistive materials as force sensors in consumer and medical devices; and so on.

Here too complex devices took time and in fact many are yet to success despite years of research, many hundreds of millions of dollars’ worth of investments, and numerous failed companies/projects. The industry did however not wait on a fully printed solution and went hybrid, using a printed electronic component only when it made sense.

We find that the SCE is following a similar path: the industry is not waiting for a fully stretchable solution to appear, and simpler devices are steaming ahead to identify and address specific needs. This trend will continue in the years to come, making SCE a major commercial reality composed of many disparate and diverse success stories. This will prevent one from making generalized sweeping statements about the SCE market as one single entity, but does not stop the market from growing to reach a $600M aggregate opportunity by 2027.

To learn more please see www.IDTechEx.com/stretch.

Learn more at the next leading event on the topic: IDTechEx Show! Europe 2018 on 11 – 12 Apr 2018 in Estrel Convention Center, Berlin, Germany hosted by IDTechEx.